At Par Value Meaning

What is par value of share.

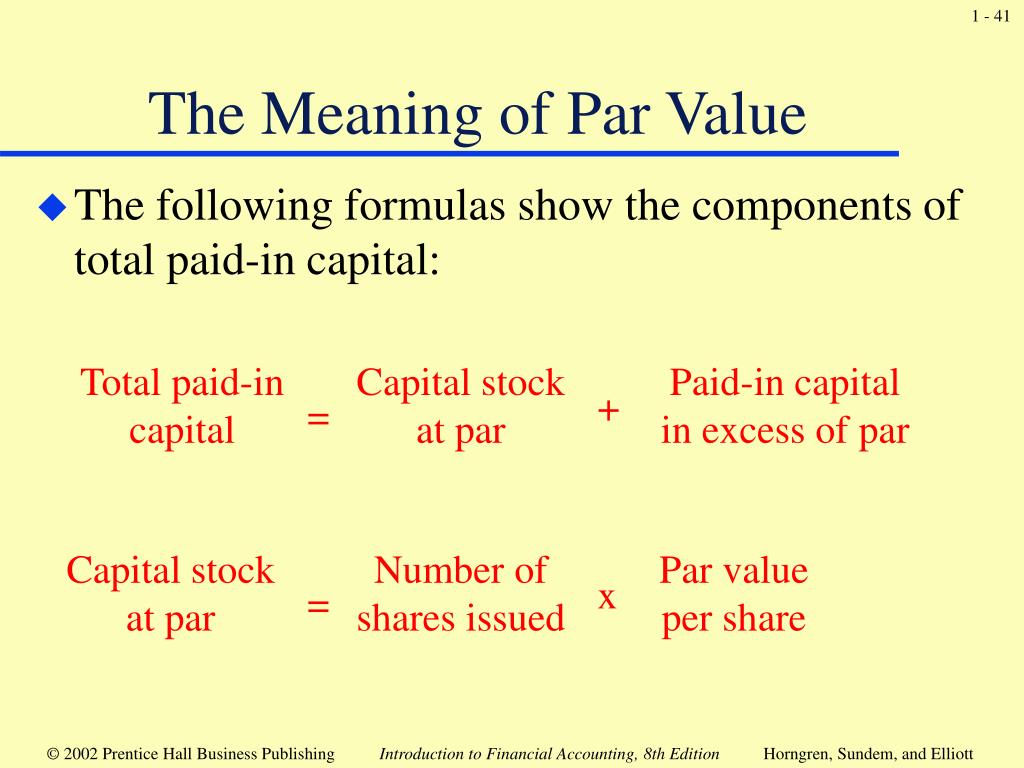

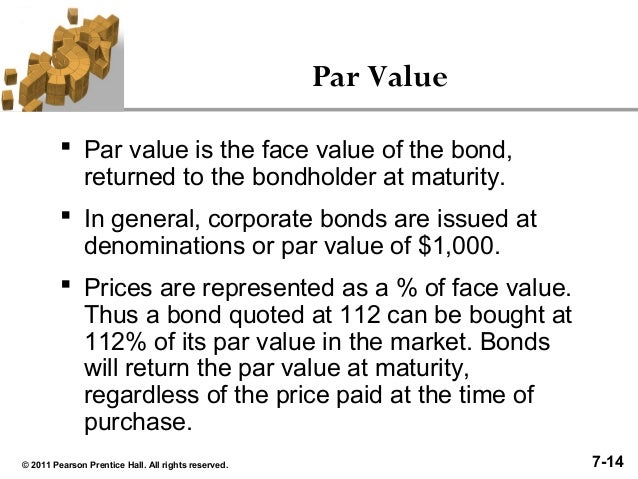

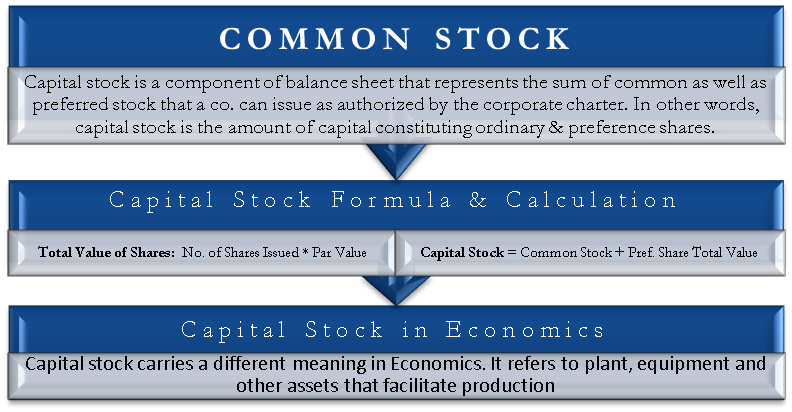

At par value meaning. For a debt security par value is the amount repaid to the. With stocks the par value which is frequently set at 1 is used as an accounting device but has no relationship to the actual market value of the stock. Par value is the face value or named value of a stock or bond. Par value stock.

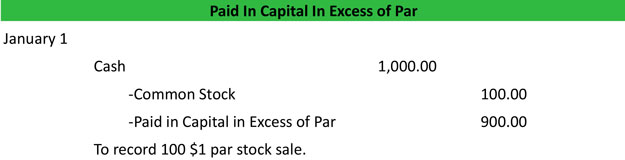

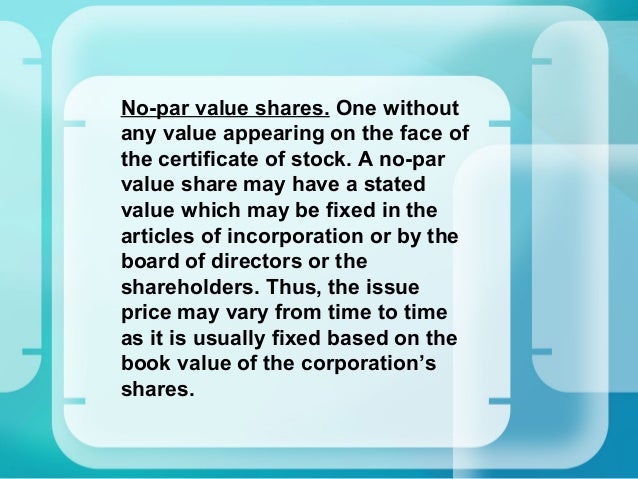

Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value. Some states may require a corporation to have a par value while others states do not require a par value par value can also refer to an amoun. If the vehicle is de registered within 10 years from its first registration date the registered owner will be entitled to a preferential additional registration fee parf rebate.

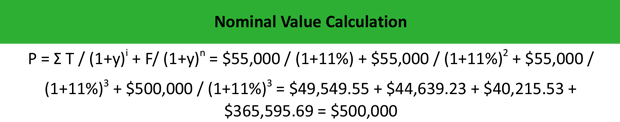

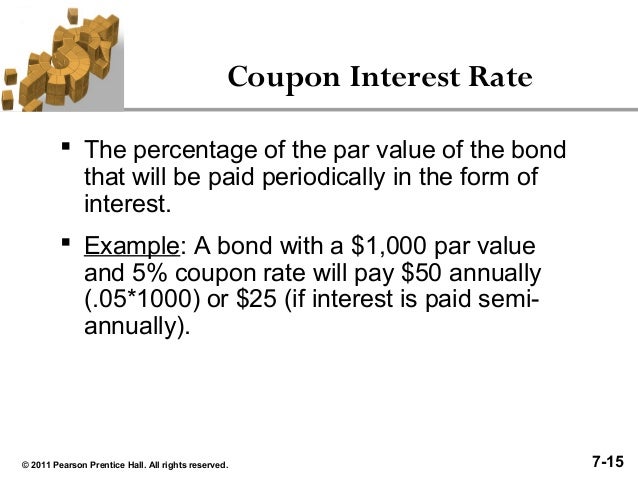

Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. Definition of par value par value is a per share amount that will appear on some stock certificates and in the corporation s articles of incorporation.

Par value is the stock price stated in a corporation s charter. This is the original cost of production of the vehicle. The nominal dollar amount assigned to a security by the issuer. Par value for stock.

The term at par is also used when two currencies are exchanged at equal value for instance in 1964 trinidad and tobago switched from the british west indies dollar to the new trinidad and tobago dollar and that switch was at par meaning that the central bank of trinidad and tobago replaced each old dollar with a new one. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. Companies sell stock as a means of generating equity capital so the par value multiplied by the total number of shares issued is the minimum amount of capital that will be. For an equity security par value is usually a very small amount that bears no relationship to its market price except for preferred stock in which case par value is used to calculate dividend payments.