Calculate Par Yield In Excel

Calculate the current yield and the yield to maturity assume a 10 year 1 000 par value bond with a 10 percent annual coupon if its required rate of return is 10 percent what is the value of the bond.

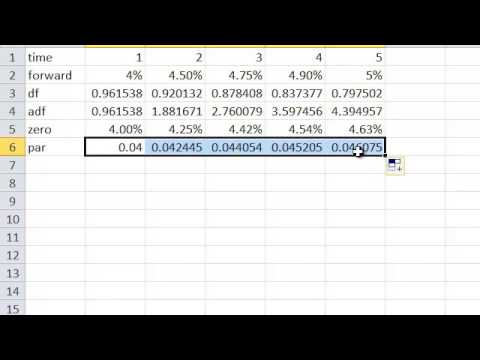

Calculate par yield in excel. How to calculate par yield. Par value of bond face value fv. The function is generally used to calculate bond yield. There are two main forms of investments.

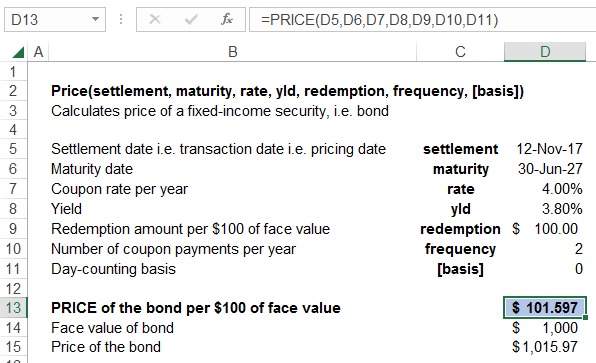

As a financial analyst we often calculate the yield on a bond to determine the income that would be generated in a. Once created the desired data will automatically appear in designated cells when the required input values are entered. Coupons per year npery. Formula to calculate bond price.

The company pays interest two times a year semi annually. Most bonds are offered at a premium or discount to par. How to calculate yield to maturity ytm in excel 1 using rate function. Suppose you got an offer to invest in a bond.

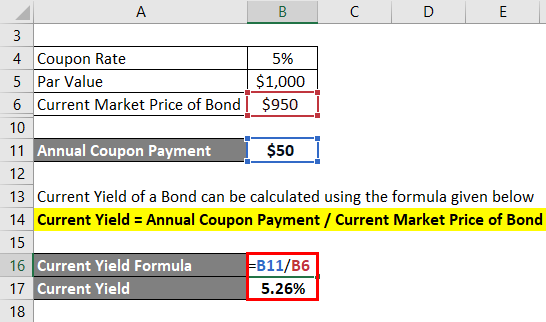

Here are the details of the bond. To calculate the current yield of a bond in microsoft excel enter the bond value the coupon rate and the bond price into adjacent cells e g a1 through a3. A bond yield calculator capable of accurately tracking the current yield the yield to maturity and the yield to call of a given bond can be assembled in a microsoft excel spread sheet. The yield function is categorized under excel financial functions.

It will calculate the yield on a security that pays periodic interest. Find out the best practices for most financial modeling to price a bonds calculate coupon payments then learn how to calculate a bond s yield to maturity in microsoft excel.