No Par Value Shares Of A Single Class

Division of a class s246f 1 a.

No par value shares of a single class. New issue current class s254x 1 new shares are issued within a current class e g. After the implementation date of the companies act a pre existing company may not authorise any new par value shares authorise any shares having a nominal value or do any subdivision thereof. Note that in terms of the companies act 71 of 2008 the new act a company can no longer authorise par value shares but the par value shares which have already been authorised issued will continue to exist unless converted by way of moi amendment. 500 a class shares become 600 a class shares change to company details.

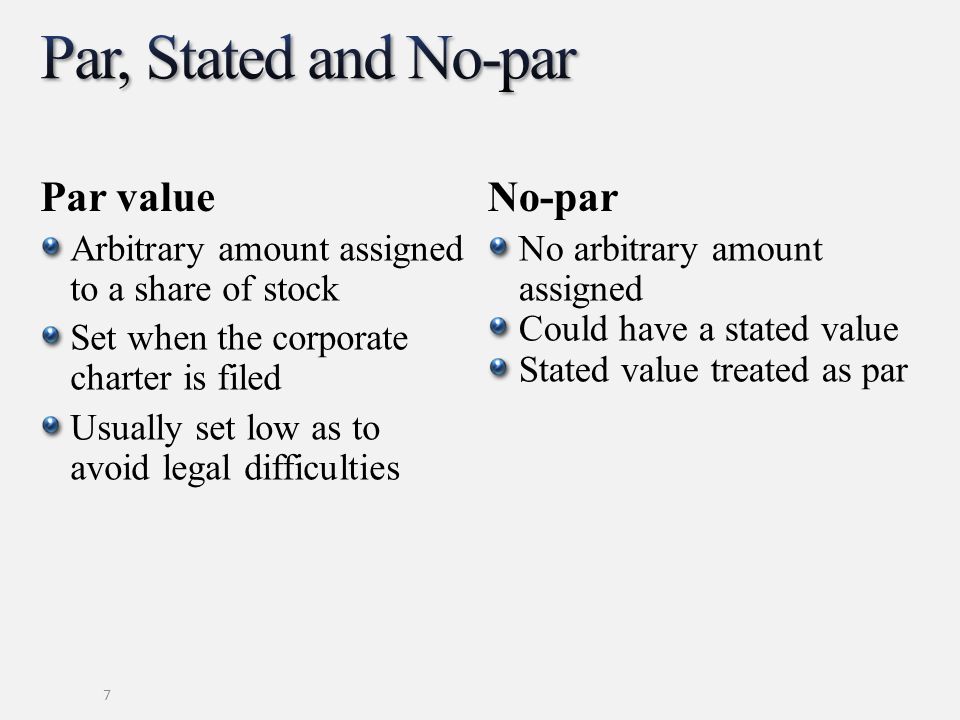

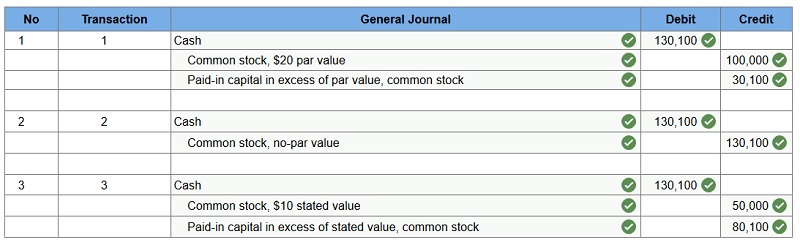

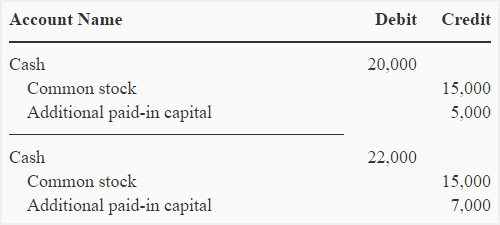

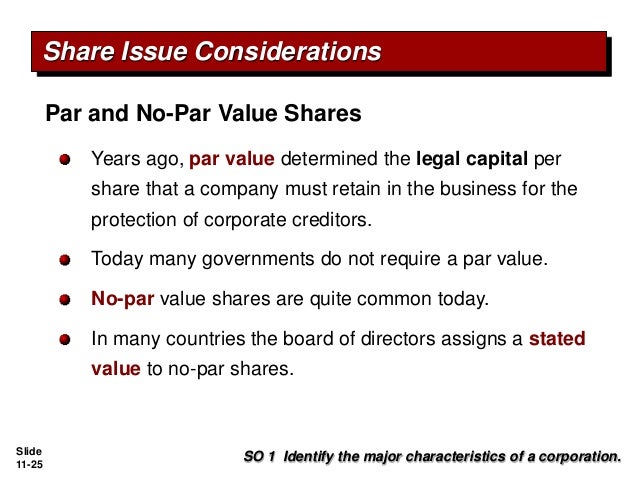

Within 28 days after the issue. The issuing company promises not to issue further shares below par value so investors can be confident that no one else will receive a more favorable issue price. The par value also has important accounting and tax implications. For example if a corporation issues 100 new shares of its common stock for a total of 2 000 and the.

The par value of a share is the value stated in the corporate charter below which shares of that class cannot be sold upon initial offering. This column states the par value of the class of shares. Shares issued in terms of the 2008 act have no nominal or par value. Change to company details.

Within 28 days after the issue. From an accounting standpoint the par value of an issued share of common stock must be recorded in an account separate from the amount received over and above the amount of par value. A new class of shares is issued. The board must determine the price or other adequate considerations at which shares may be issued.

So the par value on common stock is a legal consideration. The par value of the shares is the minimum price the directors may issue the shares. So for the purposes of the current share sale the moi will not need to be amended.

/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)