Par Value Bond Coupon

Rs 15 pvaf 17 6 years 110 pvdf 17 6 years rs.

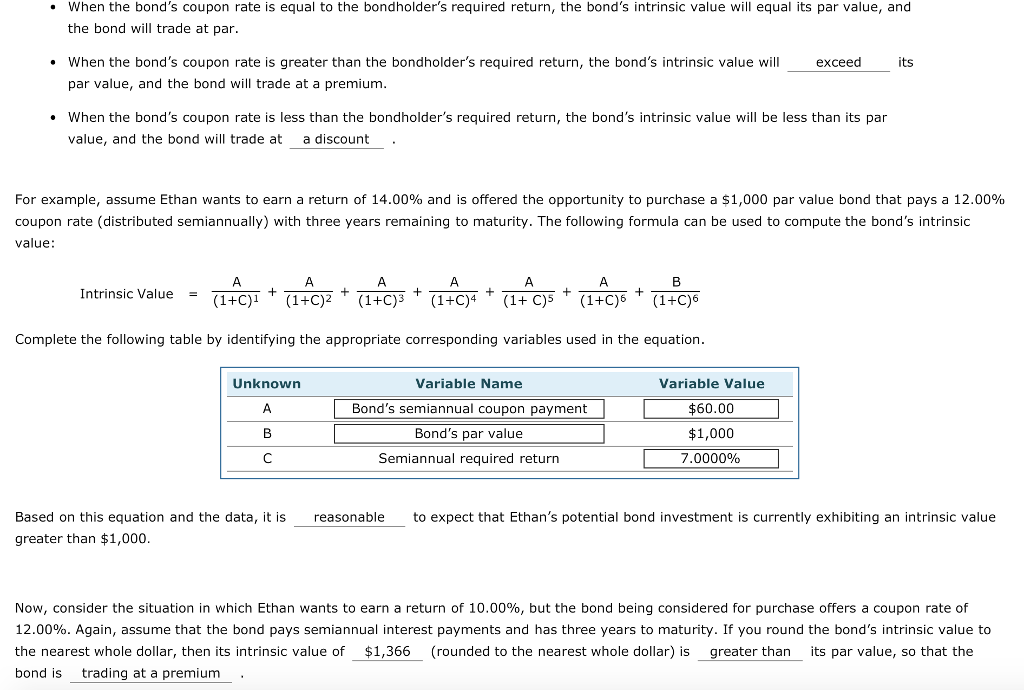

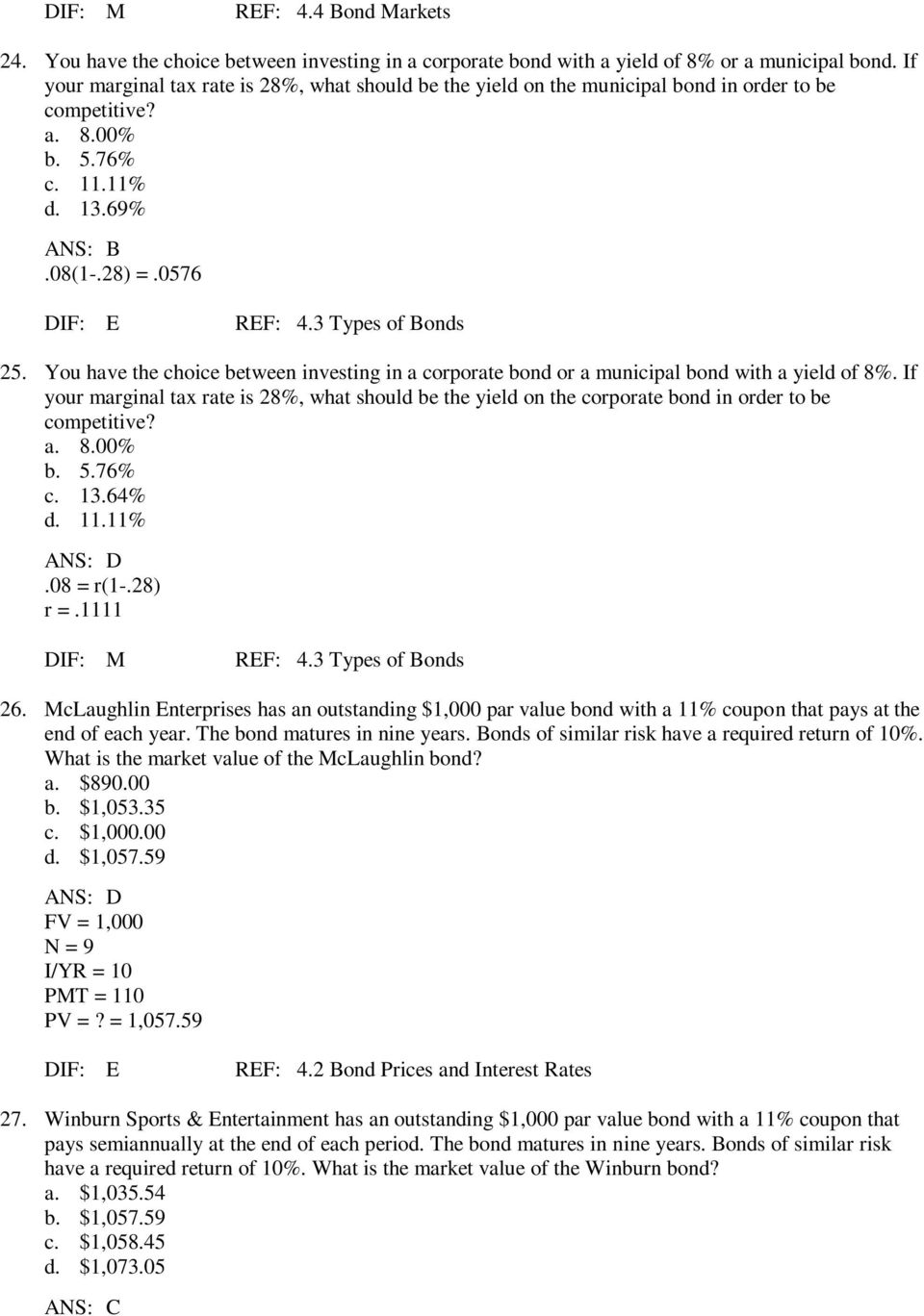

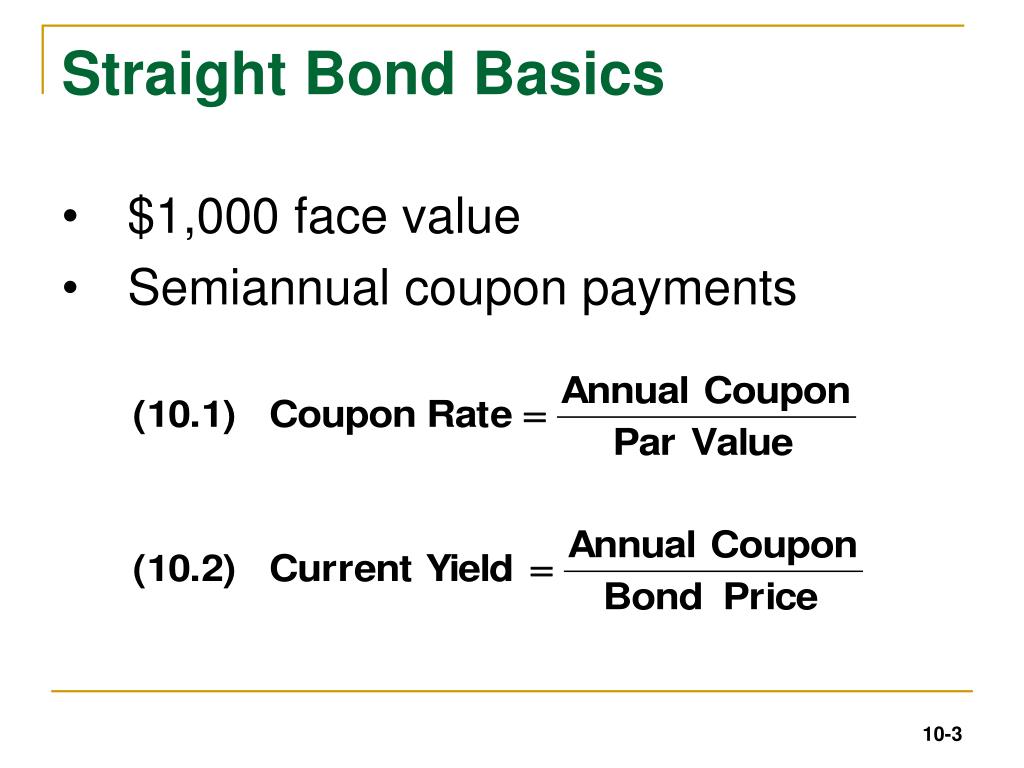

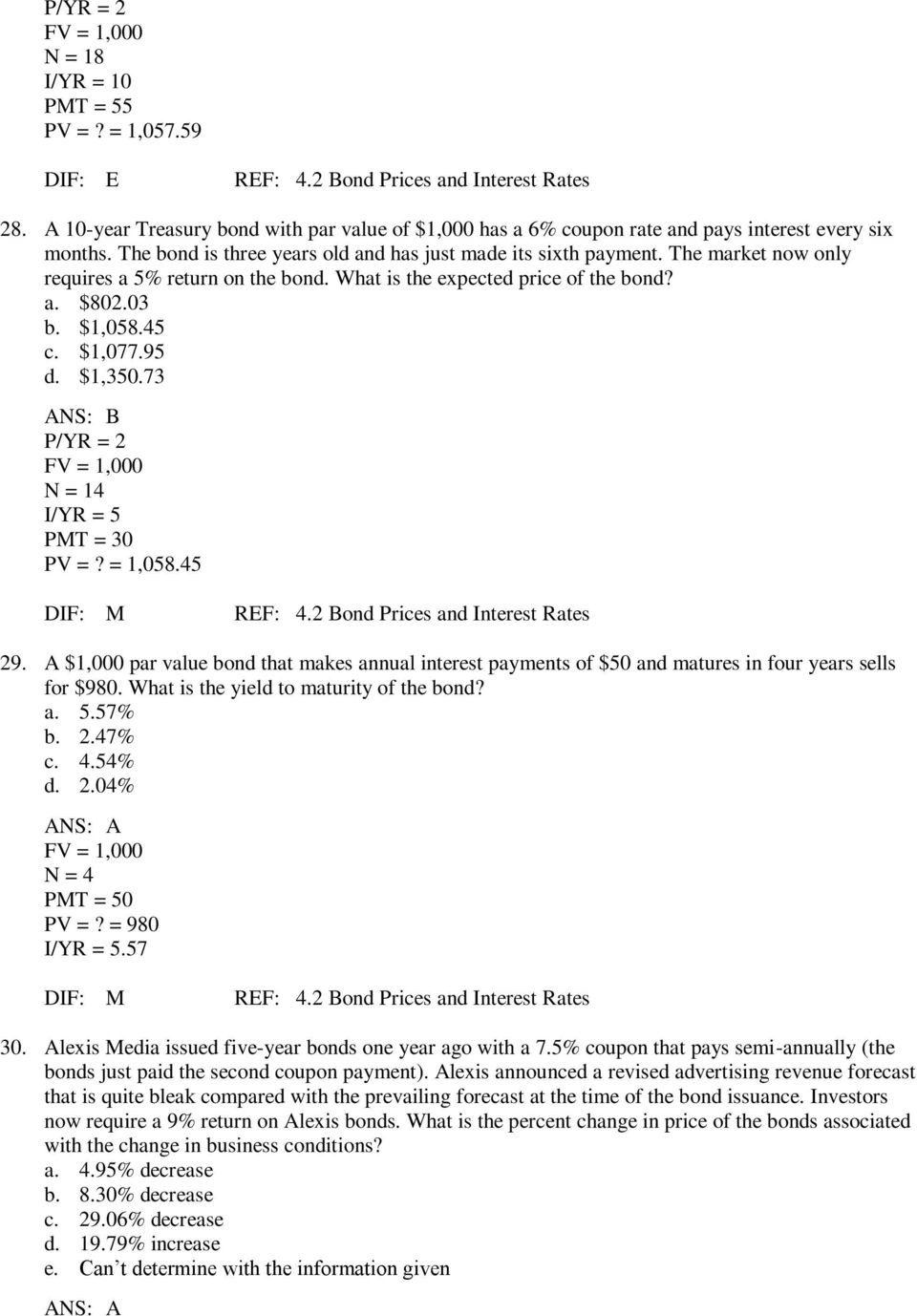

Par value bond coupon. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. For instance a company might issue 500 15 year bonds to the public. If there is a 5 coupon on a 1000 face value bond the bondholder will receive 50 every year. The coupon is set when the bond is issued and is usually expressed as an annual percentage of the par value of the bond.

Payments usually occur every six months but this can vary. Is priced at par. Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond s par value. Par value is the face value of a bond.

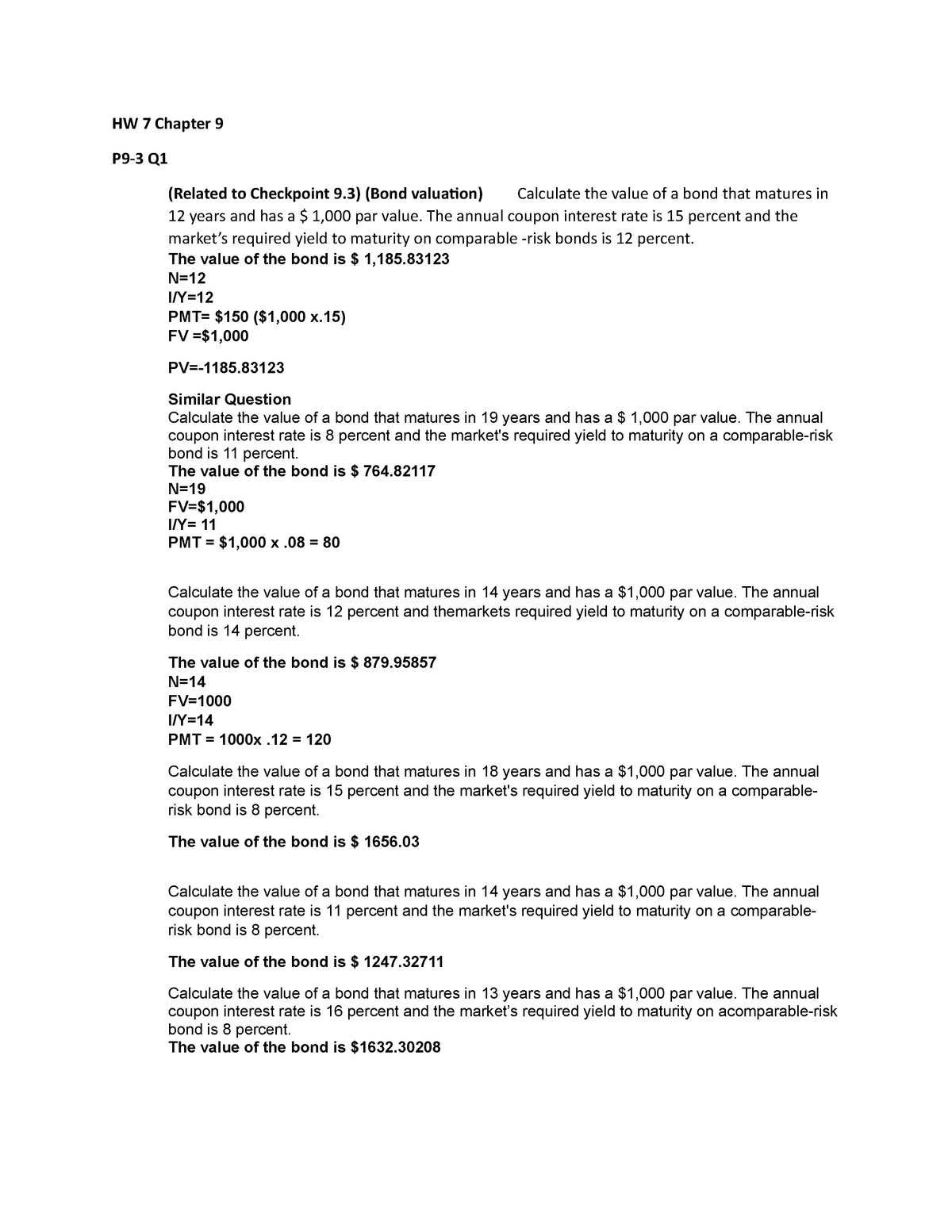

As a simple example consider a zero coupon bond with a face or par value of 1200 and a maturity of one year. Therefore each bond will be priced at 1 041 58 and said to be traded at a premium bond price higher than par value because the coupon rate is higher than the ytm. Coupon rate is the yield paid by a fixed income security which is the annual coupon payments paid by the issuer relative to the bond s face or par value. Coupon rate compounding frequency that can be annually semi annually quarterly si monthly.

The bond has a six year maturity value and has a premium of 10. Find present value of the bond when par value or face value is rs. Finance q a library debt. To understand why a bond with a coupon rate equal to the market interest rate interest rate an interest rate refers to the amount charged by a lender to a borrower for any form of debt given generally expressed as a percentage of the principal.

Understanding a par bond. So it will be 1 041 58. If the required rate of returns is 17 the value of the bond will be. 15 x 3 589 110 390.

The par value of a bond also called the face amount or face value is the value written on the front of the bond. 3 500 000 par value of outstanding bond that pays annually 10 coupon rate with an annual before tax yield to maturity of 12. 5 500 000 book value of outstanding ordinary shares. If the issuer sells the bond for 1 000 then it is essentially offering investors a 20 return on their investment or a one year interest rate of 20.

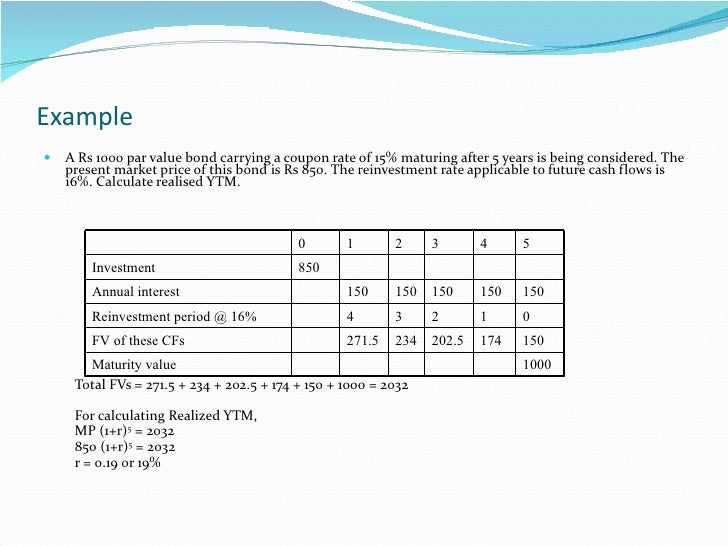

Face par value which is the amount of money the bond holder expects to receive from the issuer at the maturity date as agreed. 100 coupon rate is 15 current market price is rs. The bond issue has face value of 1 000 and will mature in 20 years.