Par Value Dividend Definition

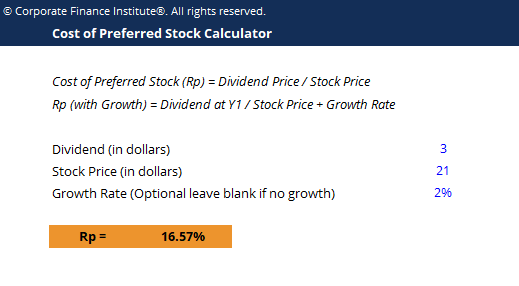

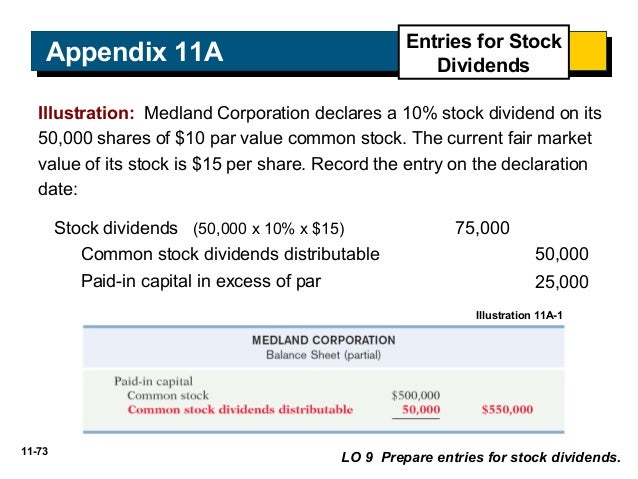

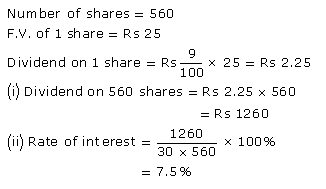

Par value of preferred stock is used in a similar way in calculating the annual dividend.

Par value dividend definition. The nominal dollar amount assigned to a security by the issuer. Par value synonyms par value pronunciation par value translation english dictionary definition of par value. Par value is the face value of a bond. The value imprinted on the face of a share certificate or bond and used to assess dividend capital ownership or interest.

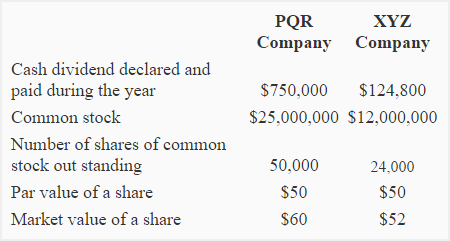

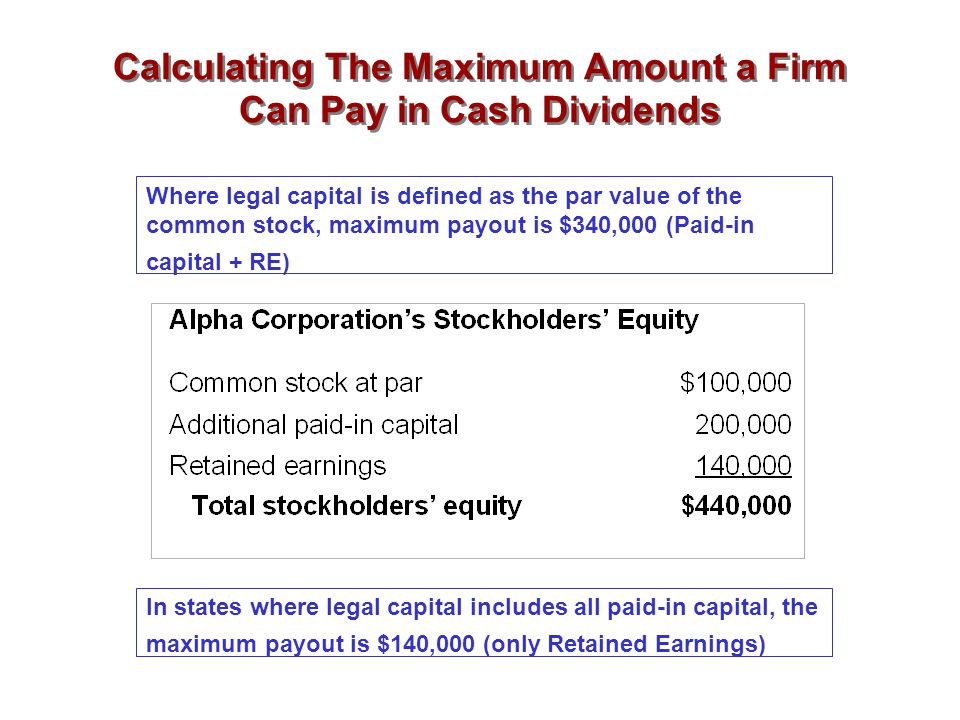

Companies sell stock as a means of generating equity capital so the par value multiplied by the total number of shares issued is the minimum amount of capital that will be. For an equity security par value is usually a very small amount that bears no relationship to its market price except for preferred stock in which case par value is used to calculate dividend payments. The stated value of a security as it appears on its certificate. Par value stock.

In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. Par value in finance and accounting means stated value or face value.

Face value compare market value book value 2. Also called face value par. What is par value of share. Par can also refer to a bond s original issue.

For a debt security par value is the amount repaid to the.