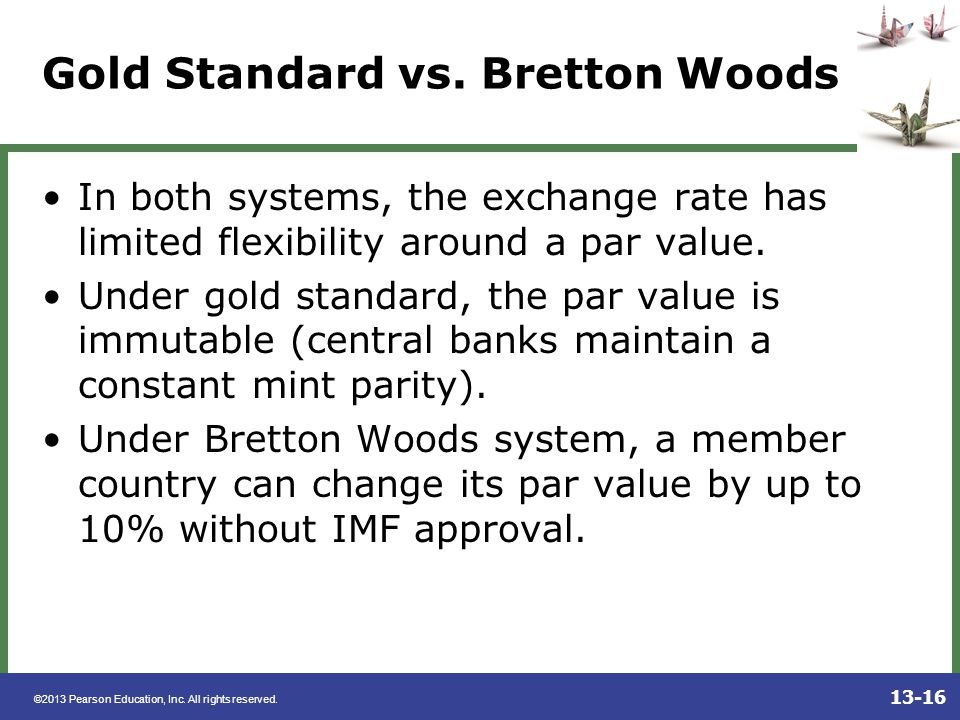

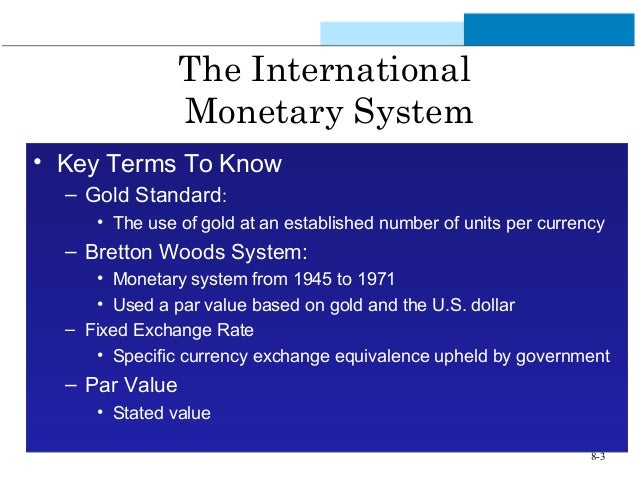

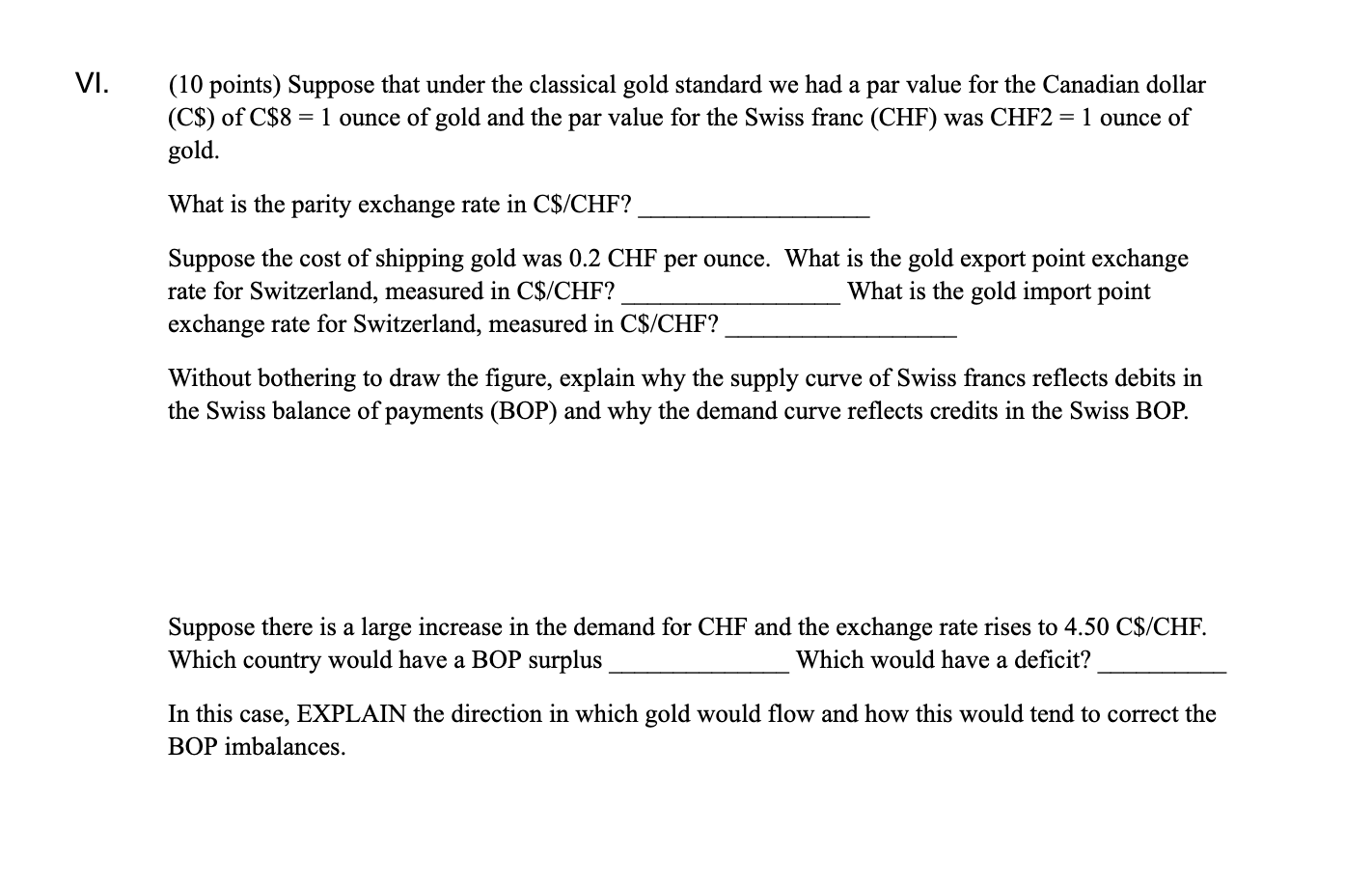

Par Value Gold Standard

The gold parity standard aims at maintaining stable exchange rates without interfering into the domestic monetary system of the member countries.

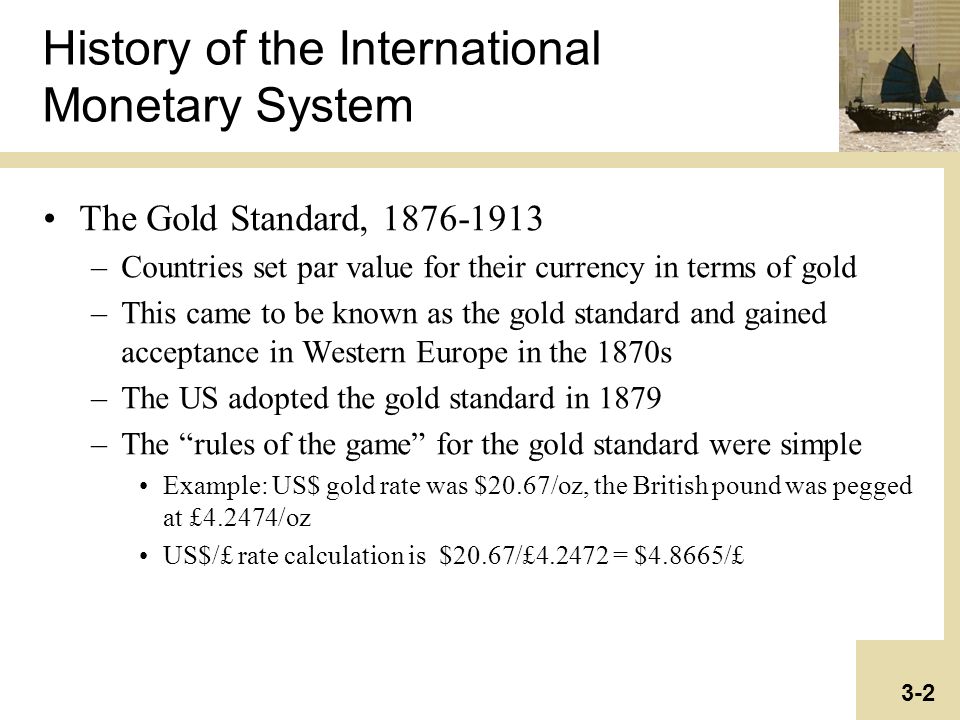

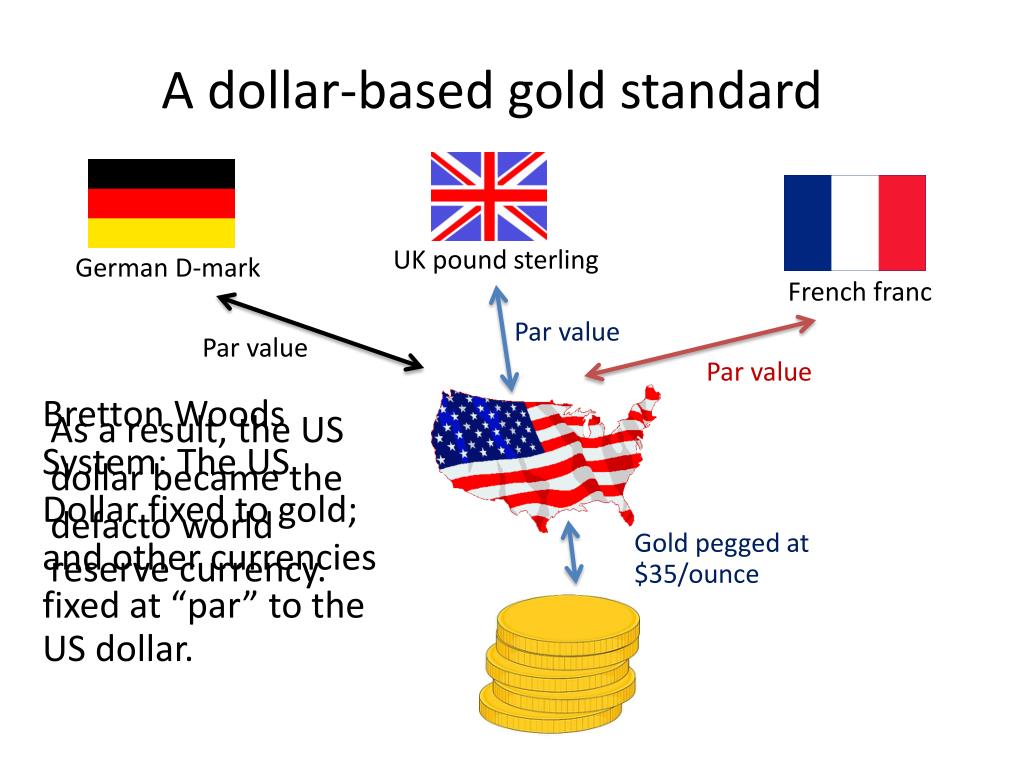

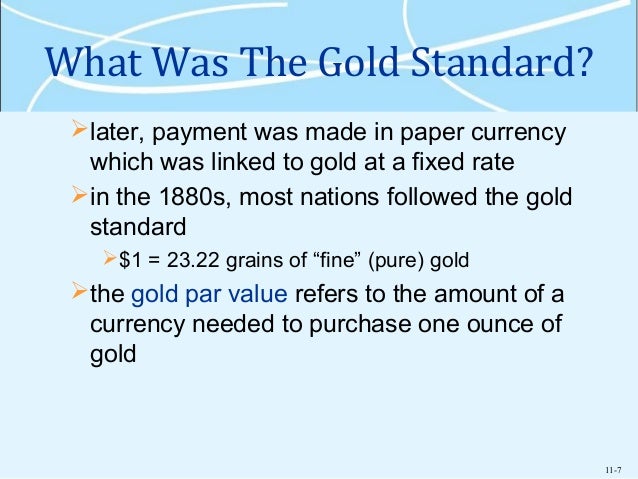

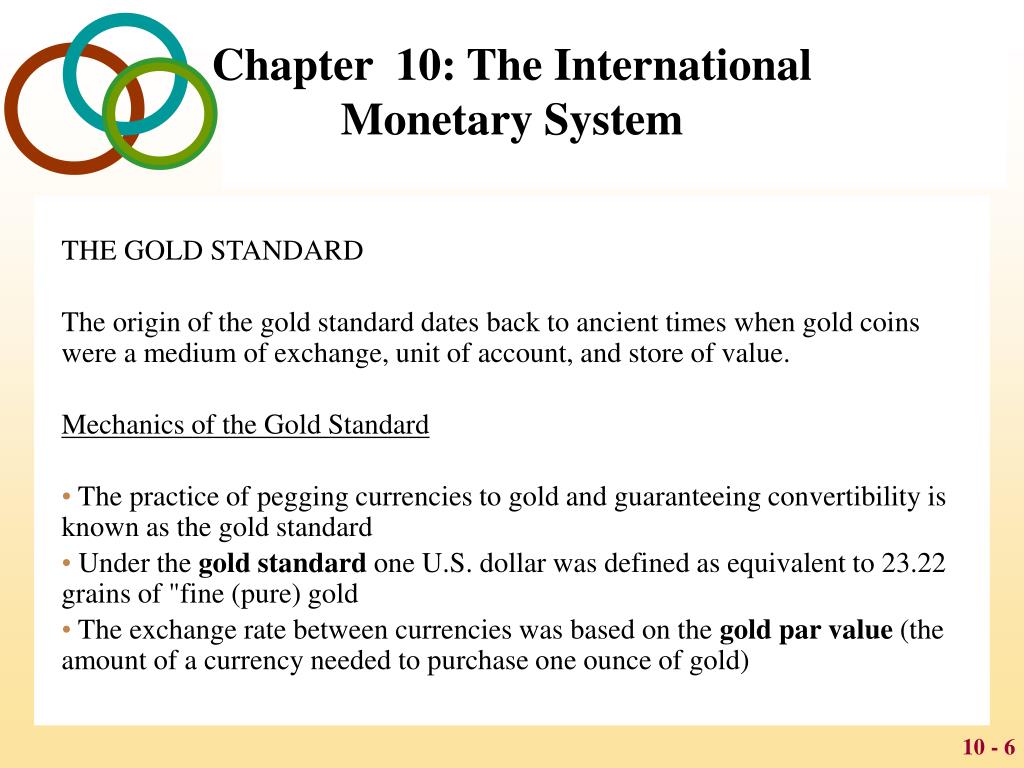

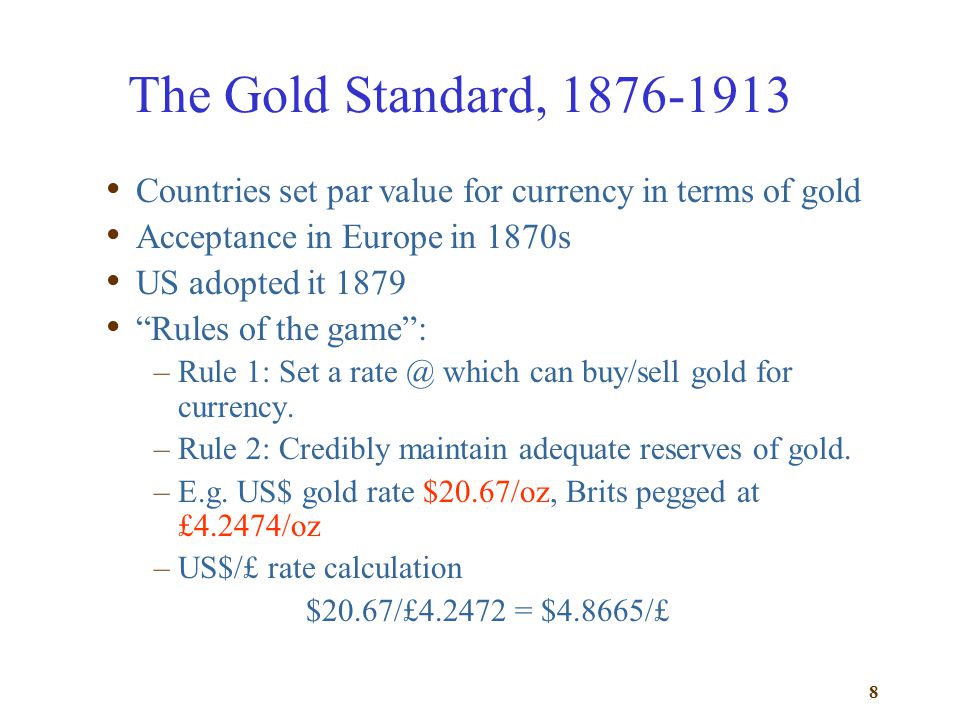

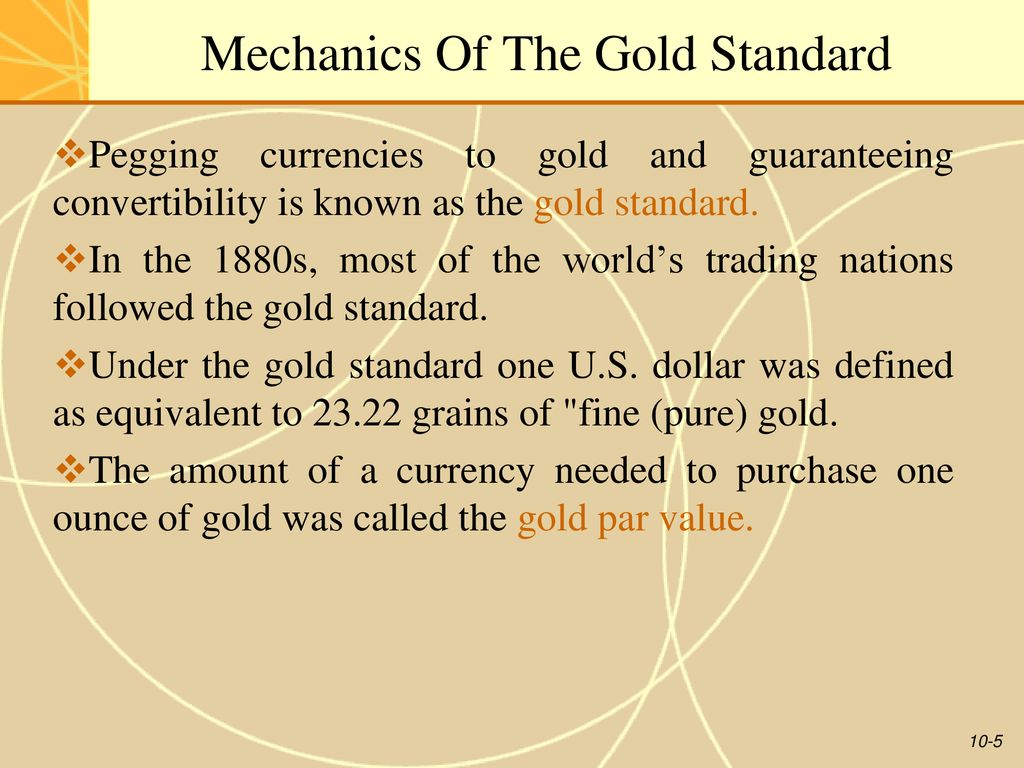

Par value gold standard. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold the gold standard was widely used in the 19th and early part of the 20th century. In our current post gold standard. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. Most nations abandoned the gold standard as the basis of their monetary systems at some point in the 20th century although many still hold substantial gold reserves.

The gold standard is a monetary system where a country s currency or paper money has a value directly linked to gold. With the gold standard countries agreed to convert paper money into a fixed. Within one percent of that par value. 1848 decreased the value of gold.

Under the gold standard the government can only print as much money as its country has in gold. Proponents of a gold standard say it provides a self regulating and stabilizing effect on the economy. The benefit of a gold standard is that a fixed asset backs the money s value.