Par Value Method Of Accounting For Treasury Stock

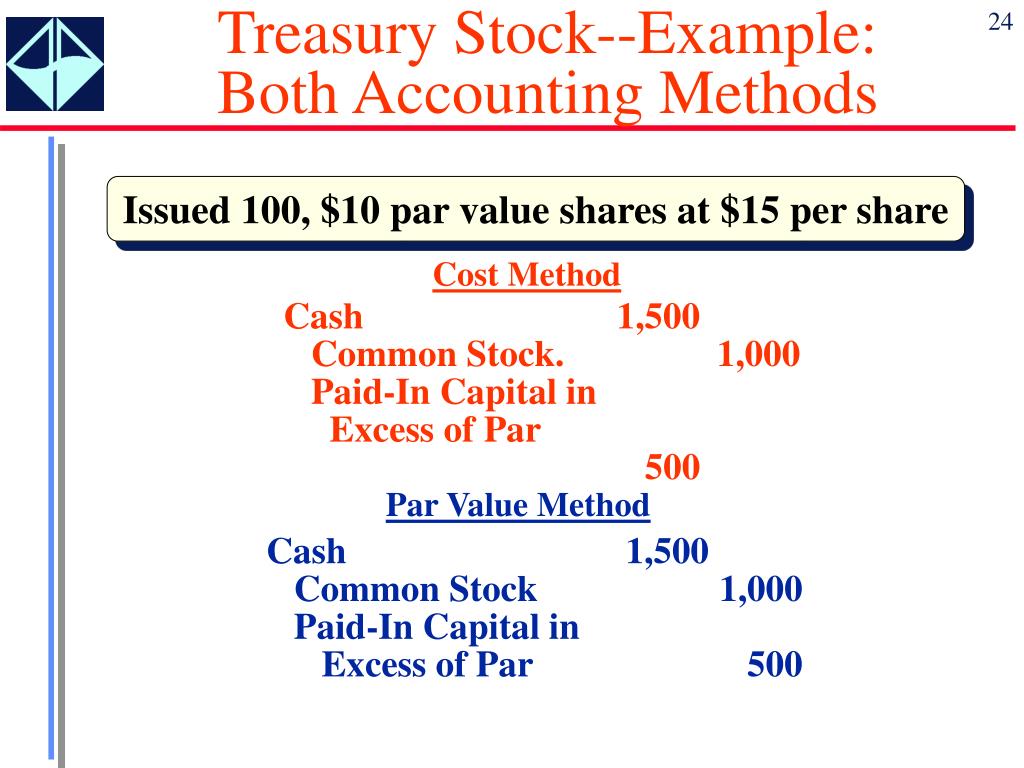

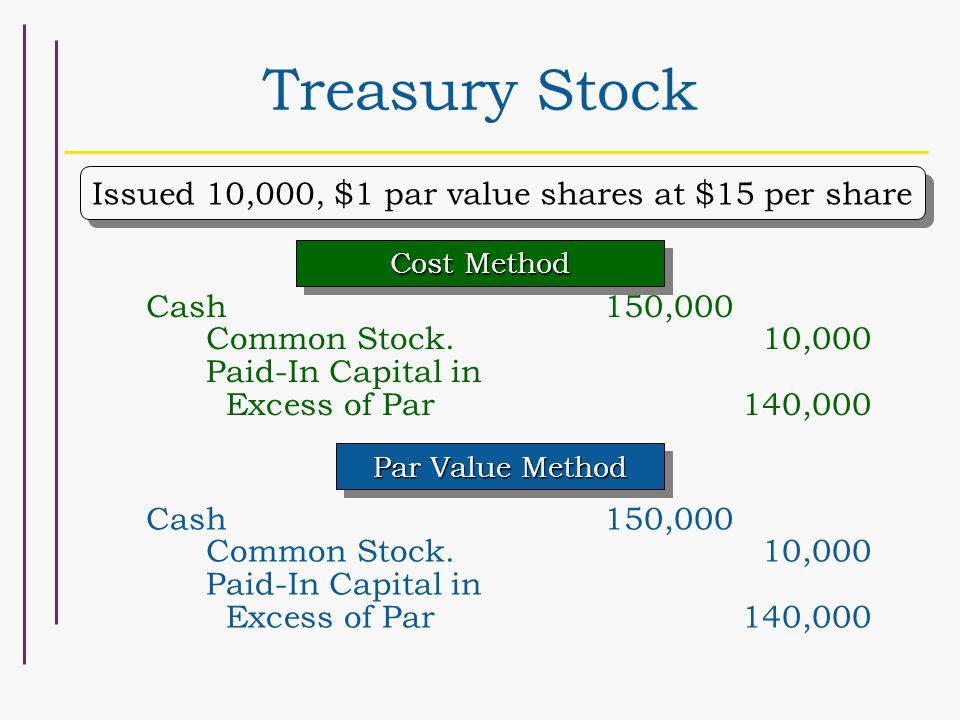

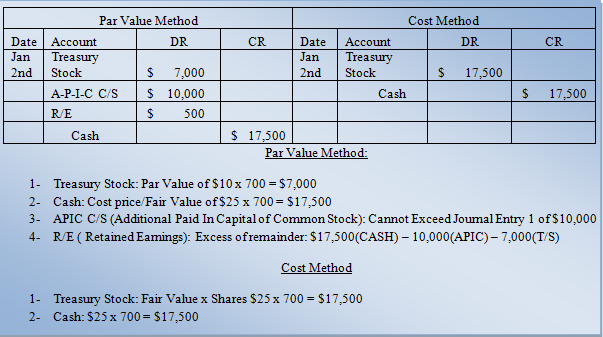

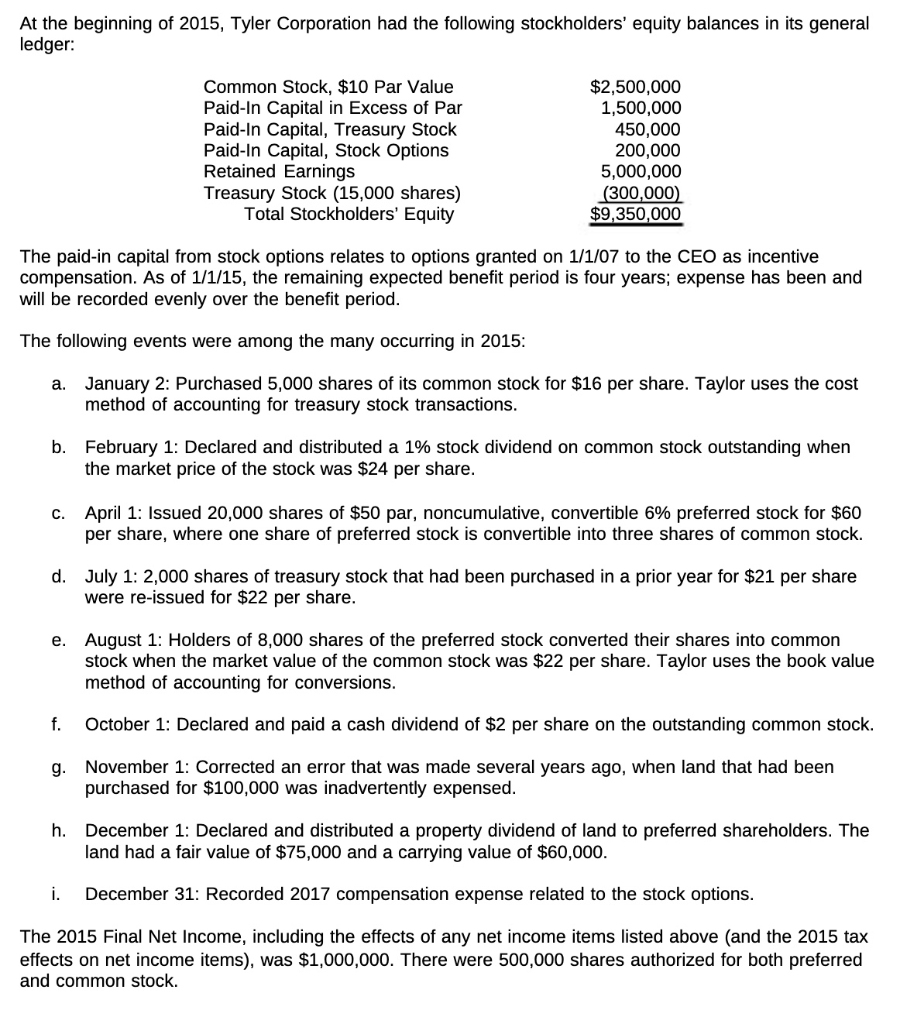

For example if a corporation acquires 100 shares of its stock at 20 each the following entry is made.

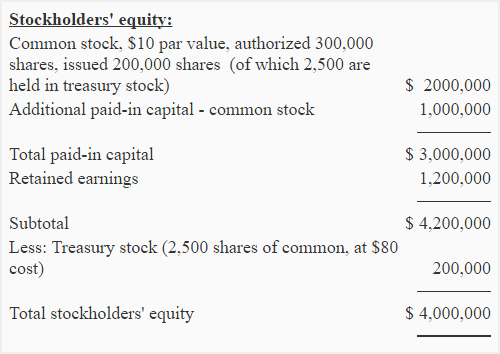

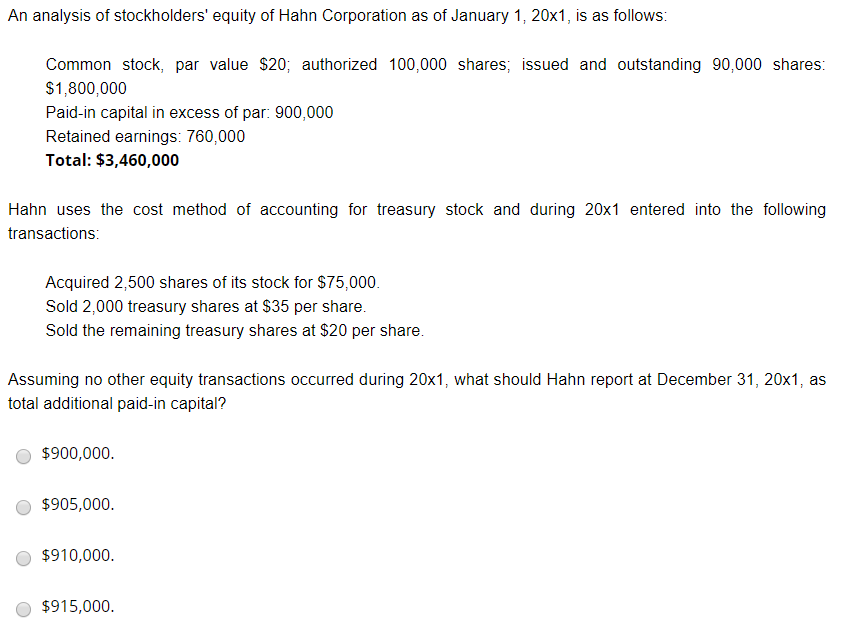

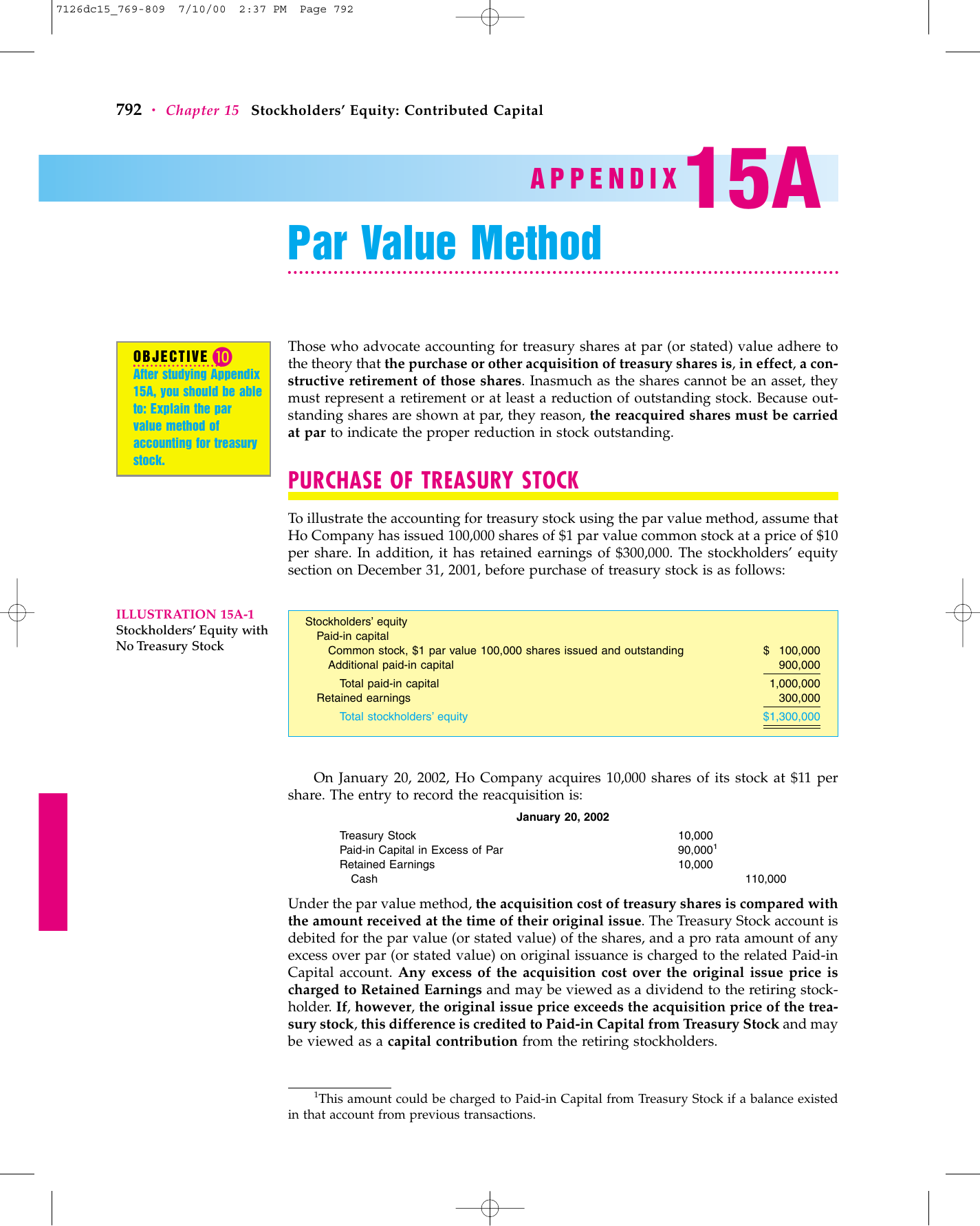

Par value method of accounting for treasury stock. An alternative method of accounting for treasury stock is the constructive retirement method. At the time of acquisition the treasury stock account is debited for the par value of. Since sunny acquired 1 000 shares and reissued 500 shares the. The following discussion explains the accounting treatment of treasury stock using par value method if you want to read about cost method please read treasury stock cost method article.

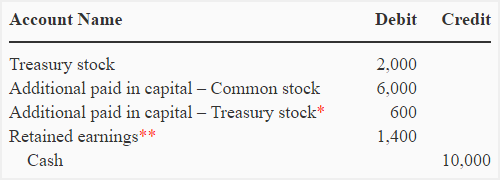

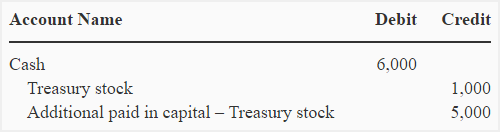

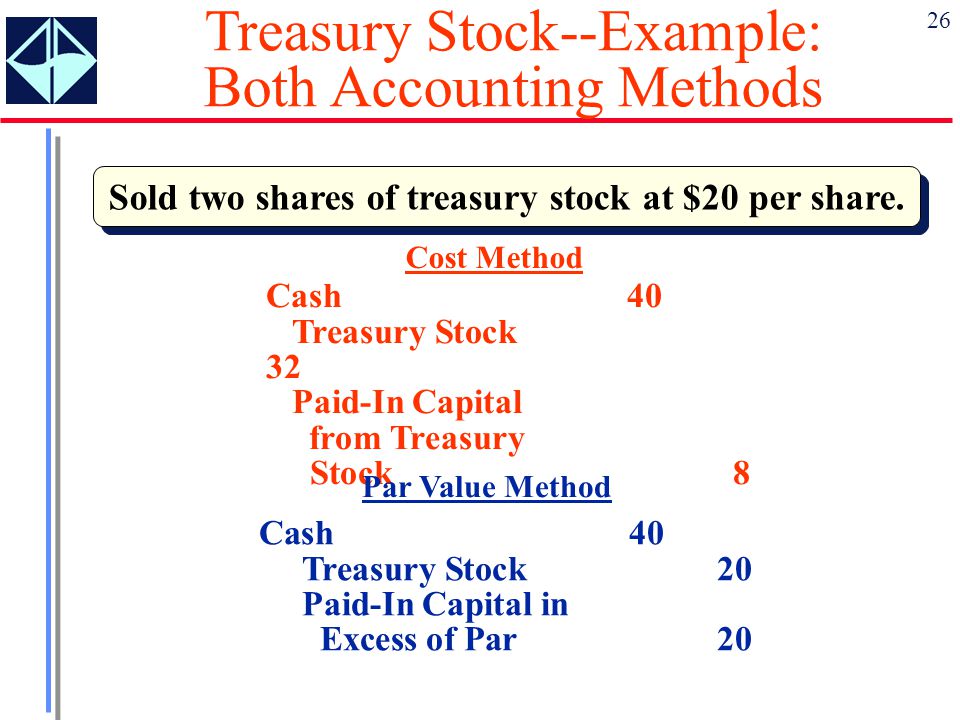

Under par value method purchase of treasury stock is recorded by debiting treasury stock by the total par value of the shares. The board of directors of armadillo industries authorizes the repurchase of 100 000 shares of its stock which has a 1 par value. The transactions relating to purchase and sale of treasury stock are generally accounted for using one of the two methods. Cash account is credited for the actual amount paid to purchase the treasury stock.

Treasury stock refers to shares which have been bought by the issuing company itself. Read morepar value method of treasury stock. The par value method is illustrated in intermediate accounting textbooks under the cost method the cost of the shares acquired is debited to the account treasury stock. These are cost method and par value method.

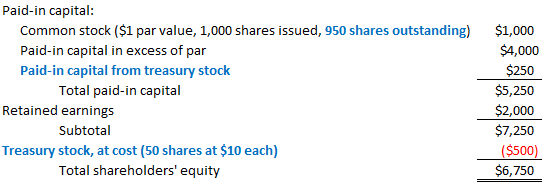

The stockholders equity section equals the same amount as the balance when using the cost method the difference is that the treasury stock balance is deducted directly from the par value of the original stock consistent with the view that acquisition of treasury stock under the par value method is the same as retiring the shares.