Par Value Stock Us Gaap

This has no relevance to the value of either in the market.

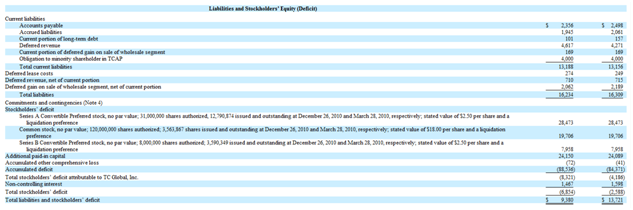

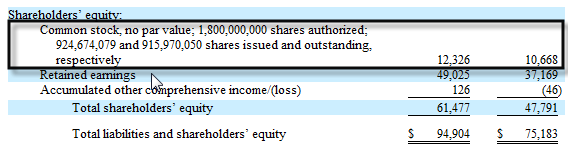

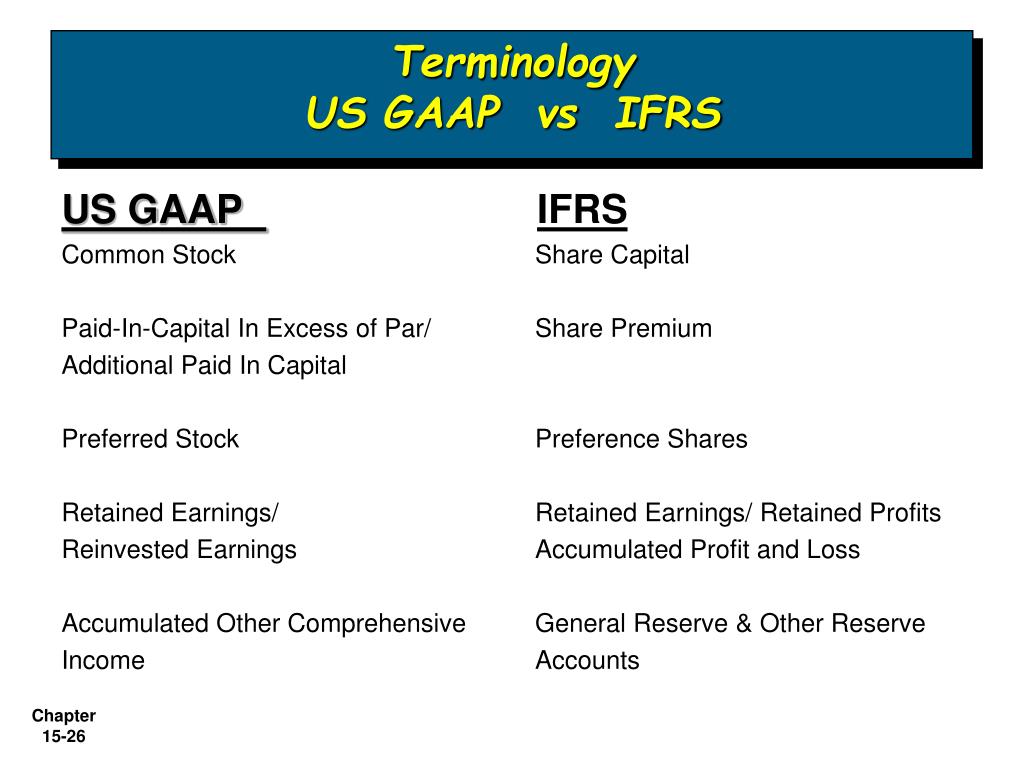

Par value stock us gaap. A par value stock unlike a no par value stock has a minimum value per share set by the company that issues it. Additional paid in capital is only dependent on the issue price of equity not the current market value. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. The value of common stock on the balance sheet is.

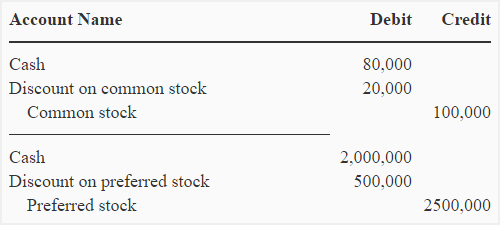

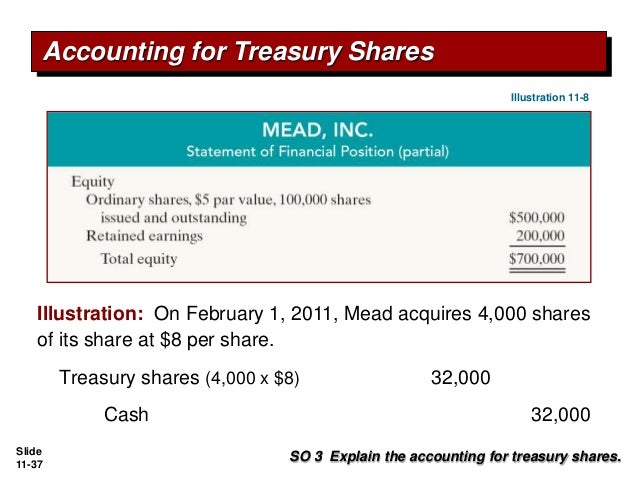

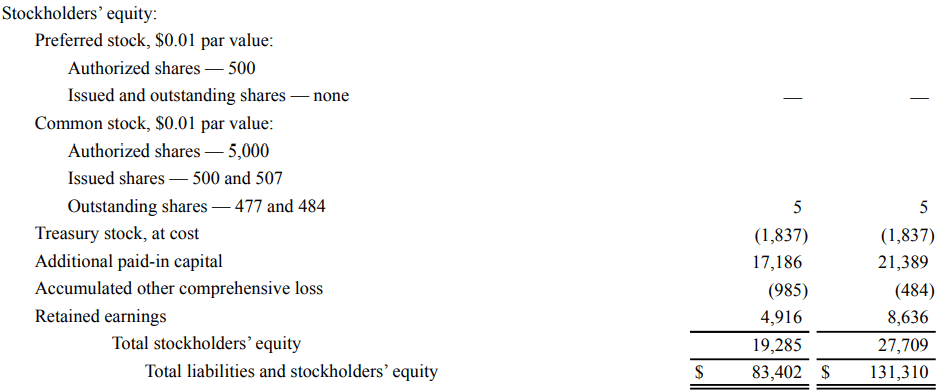

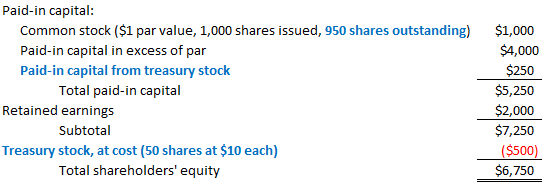

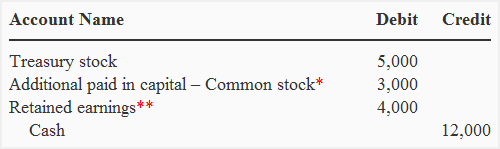

The journal entry for the retirement of treasury stock under par value method looks like the following. Although prohibited in many countries the issuance of no par value stock is allowed in some states of usa. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. What is par value of share.

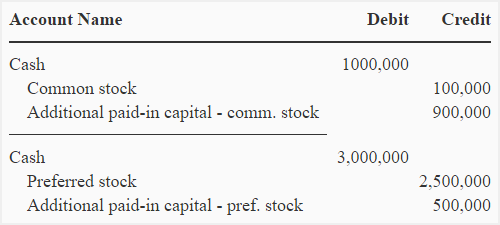

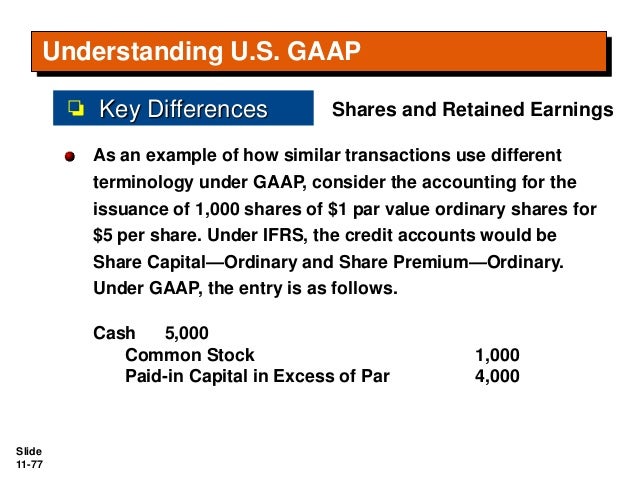

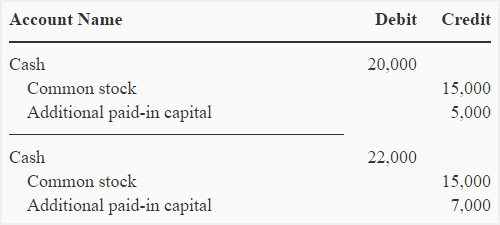

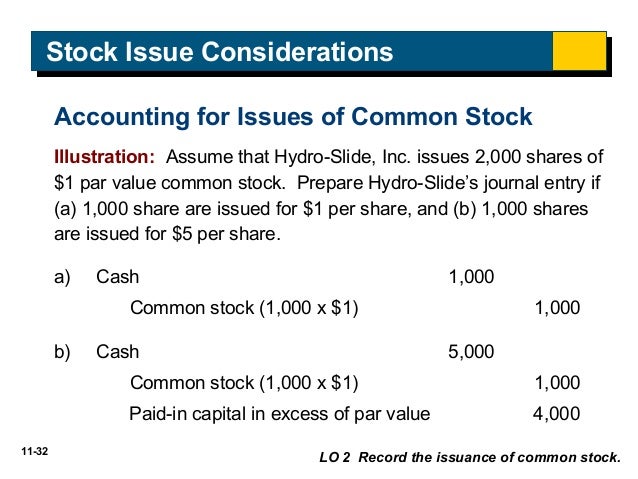

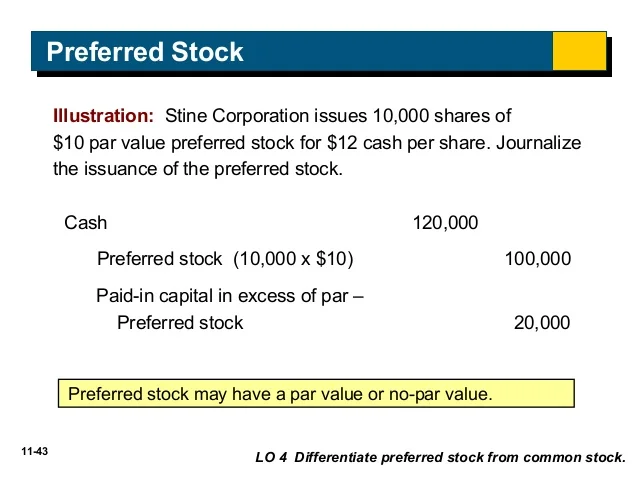

No par value stock as the name implies is a type of stock that does not have a par value attached to each of its share unlike par value stock no par value stock certificate does not have a per share value printed on it. For example if a corporation issues 100 new shares of its common stock for a total of 2 000 and the stock s par value is 1 per share the accounting entry is a debit to cash for 2 000 and a credit to common stock par 100 and a credit to paid in capital in excess of par for 1 900. If a company has 100 outstanding shares with a par value of 1 the common stock line of the balance sheet is 100. Since the par value of its common stock is only 0 000006 per share the total is less than 1 million which is the units it reports in so it shows as zero on the balance sheet.

Capital surplus also called share premium is an account which may appear on a corporation s balance sheet as a component of shareholders equity which represents the amount the corporation raises on the issue of shares in excess of their par value nominal value of the shares common stock. Par value x number of shares outstanding. The american company issued 5 000 shares of its 5 par value common stock at 8 per share. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time.

Journal entry for issuing no par value stock. Let us assume that during its ipo phase the xyz widget company issues one million shares of stock with a par value of 1 per share and that investors bid on shares for 2 4 and 10 above the. If the firm issues 10 more shares this increases to 110. Par value is usually the amount a firm agrees not to sell stock below.