Par Value Treasury Stock

I know they say far isn t deep just reallyyy wide.

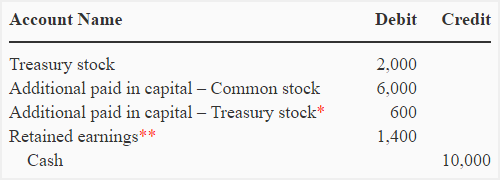

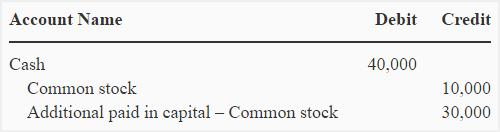

Par value treasury stock. Stock that a company issues to investors and later buys back is called treasury stock. Treasury stock may have come from a repurchase or buyback from shareholders or it may have. Par value is the face value of a bond. The resale of treasury stock is recorded by debiting cash account for the actual amount received crediting treasury stock for the par value of the treasury shares and if the cash received on resale is.

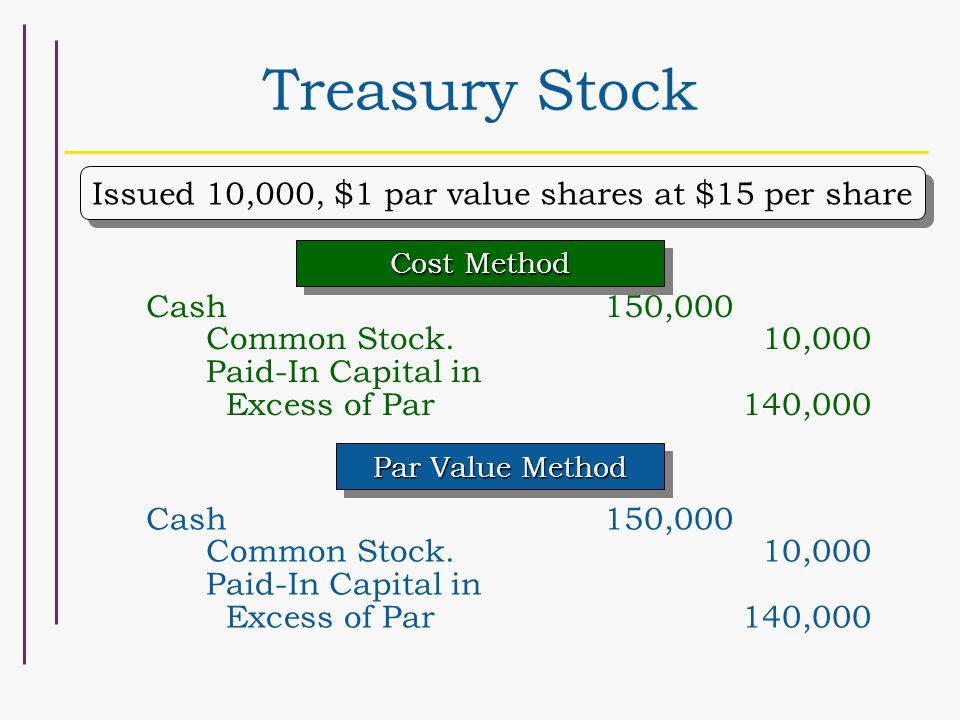

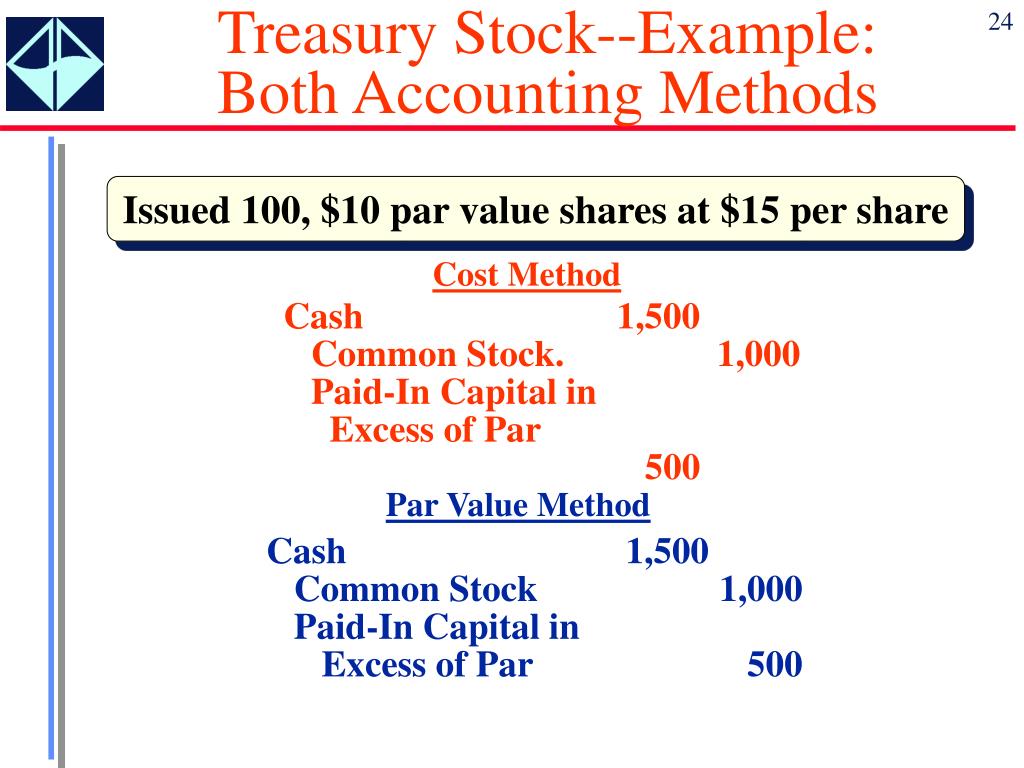

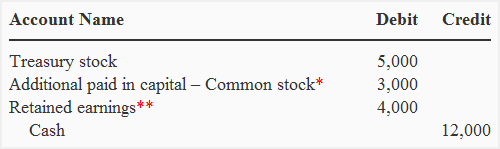

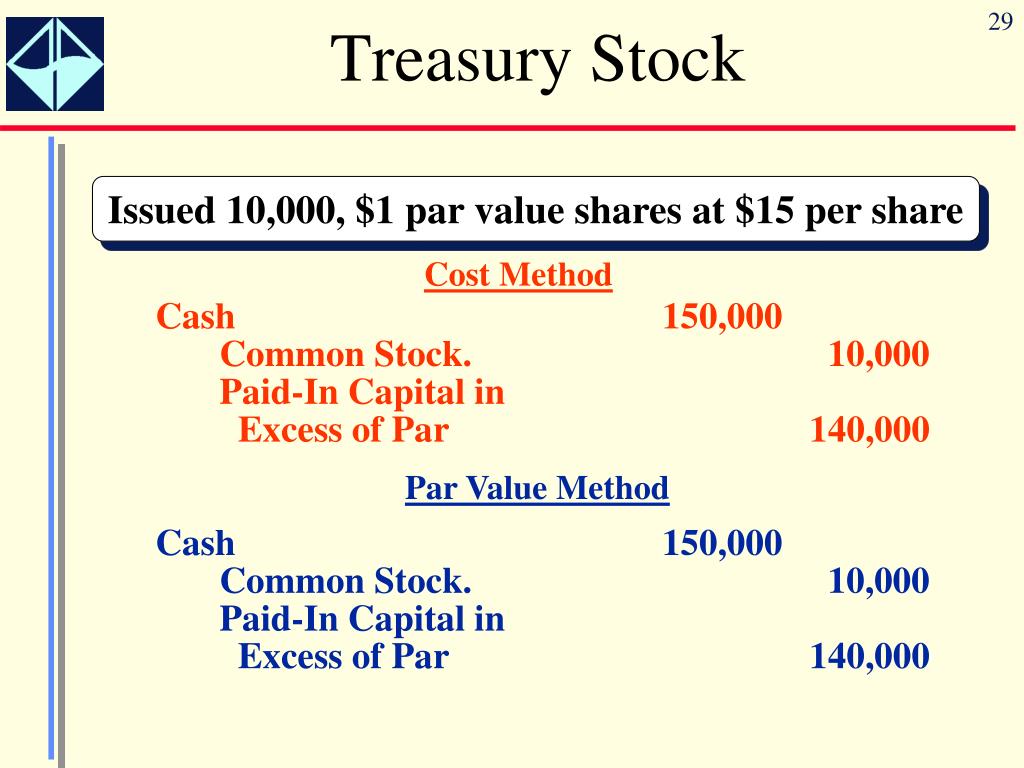

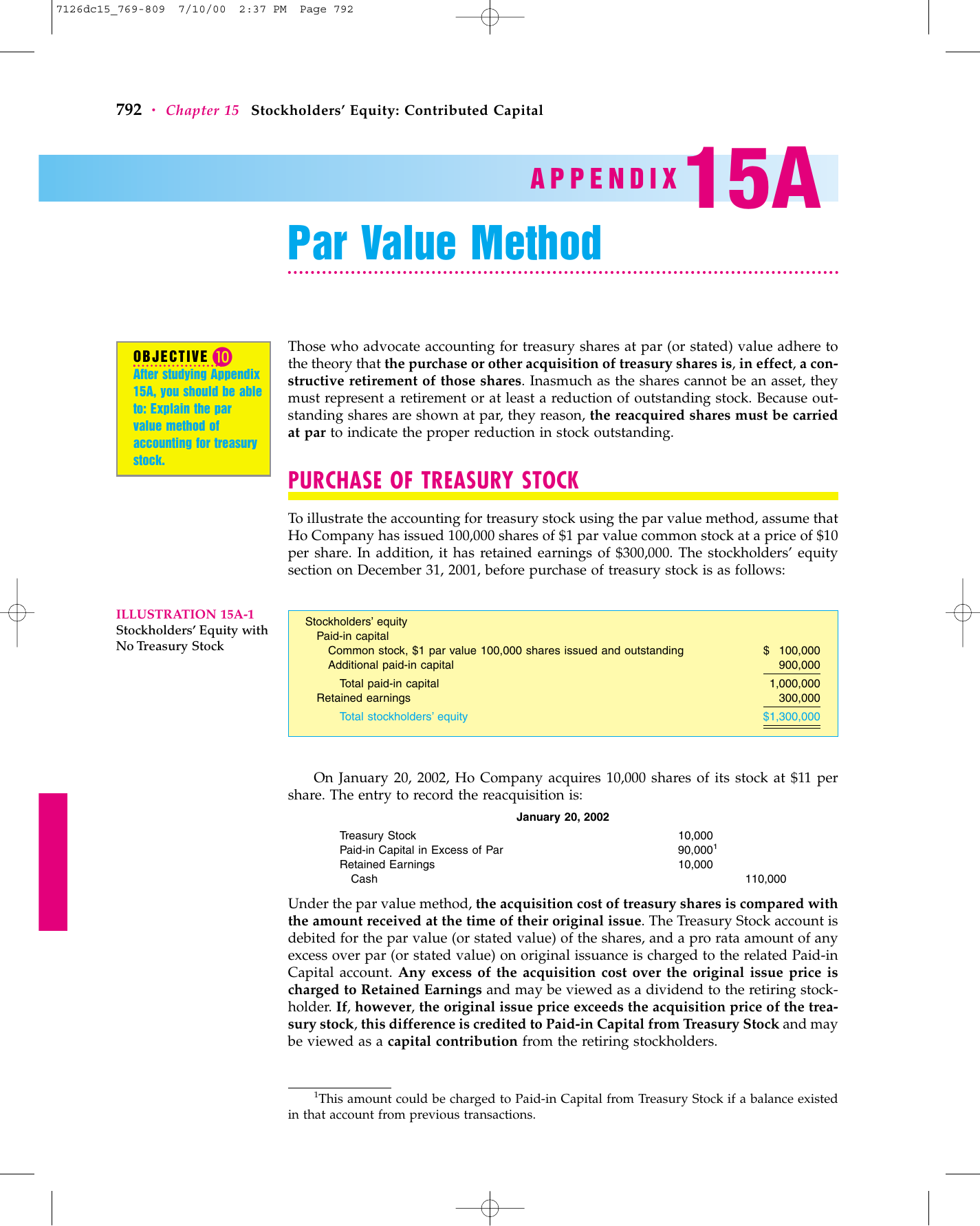

The board of directors of armadillo industries authorizes the repurchase of 100 000 shares of its stock which has a 1 par value. But i m having trouble discerning how deep i should really go. These are cost method and par value method. The transactions relating to purchase and sale of treasury stock are generally accounted for using one of the two methods.

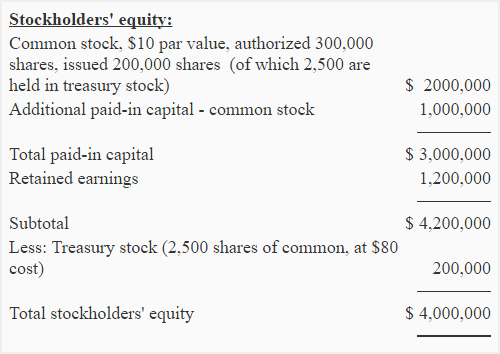

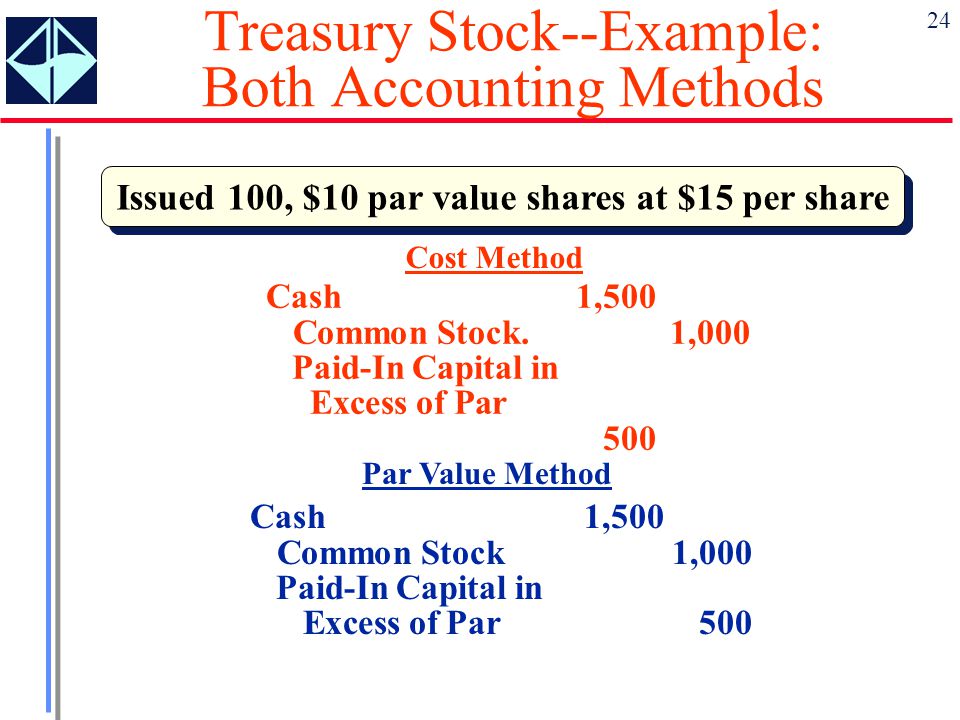

For example with accounting for treasury stock using the cost method or par method do i really need to know this. The company originally sold the shares for 12 each or 1 200 000 in total. But these profits and losses contribute only to a change in your company s stockholders equity and not your net. The par value per share is 10 and company reacquires it for 80 the entry for this transaction would be made as follows.

The shares in a corporation may be issued partly paid which renders the owner of those shares liability to the corporation for any calls on those shares up to the par value of the shares. For example eastern company repurchases 2 500 shares of its own common stock from stockholders. Your company can later resell its treasury stock for a higher or lower price resulting in a profit or loss. Since sunny acquired 1 000 shares and reissued 500 shares the.

More than the total par value of treasury shares the excess is credited to additional paid in capital account. Also par value still matters for a callable common stock. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. The par value of shares is ignored for recording the purchase of treasury stock under cost method.

The stockholders equity section equals the same amount as the balance when using the cost method the difference is that the treasury stock balance is deducted directly from the par value of the original stock consistent with the view that acquisition of treasury stock under the par value method is the same as retiring the shares. A company may elect to buy back its own shares. Treasury stock treasury shares are the portion of shares that a company keeps in its own treasury.