Par Value What Does It Mean

What is par value of share.

Par value what does it mean. A level of equality. Par can also refer to a bond s original issue. However par value is now usually set at a minimal amount such as 0 01 per share since some state laws still require that a company cannot. Some states may require a corporation to have a par value while others states do not require a par value par value can also refer to an amoun.

The gains and the losses are on a par. For instance a company might issue 500 15 year bonds to the public. This is the amount of money that bond issuers promise to be repaid bondholders at a future date. Companies sell stock as a means of generating equity capital so the par value multiplied by the total number of shares issued is the minimum amount of capital that will be.

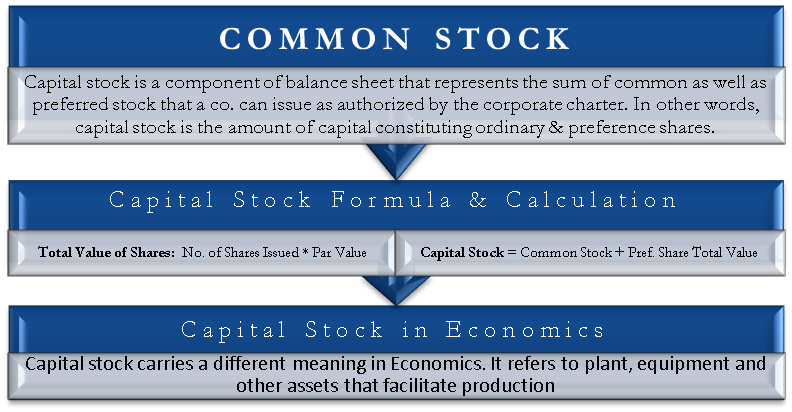

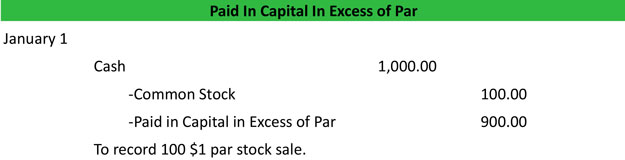

Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. What does par value stock mean. When a corporation is setup or incorporated a corporate charter is created. Definition of par value par value is a per share amount that will appear on some stock certificates and in the corporation s articles of incorporation.

The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value. Par value stock. The par value is a minimum selling value given to each share of stock. Par value in finance and accounting means stated value or face value.

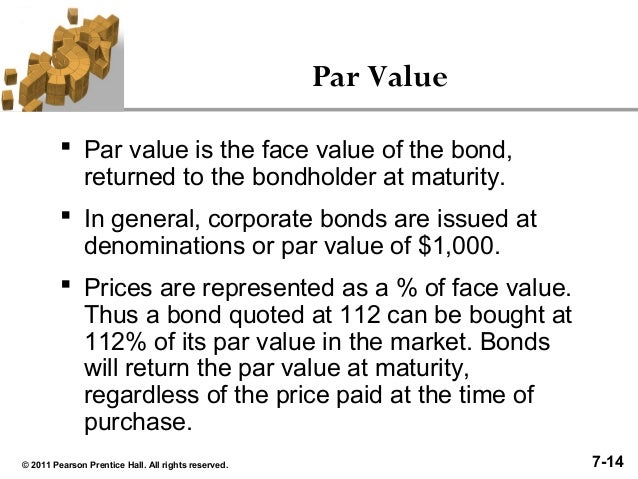

The par value of a bond also called the face amount or face value is the value written on the front of the bond. A bond selling at par is priced at 100 of face value. Par value is the stock price stated in a corporation s charter. While the par value of a bond typically remains constant for its term its market value does not.

Par value for stock. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. For example if you are earning 6 annual interest on a bond with a par value of 1 000 that means you receive 6 of 1 000 or 60.

Par value stock is one class of stock issued by a corporation that has a par value set in the corporate charter or articles of incorporation. Par is also the basis on which the interest you earn on a bond is figured.