Par Yield Curve Swaption

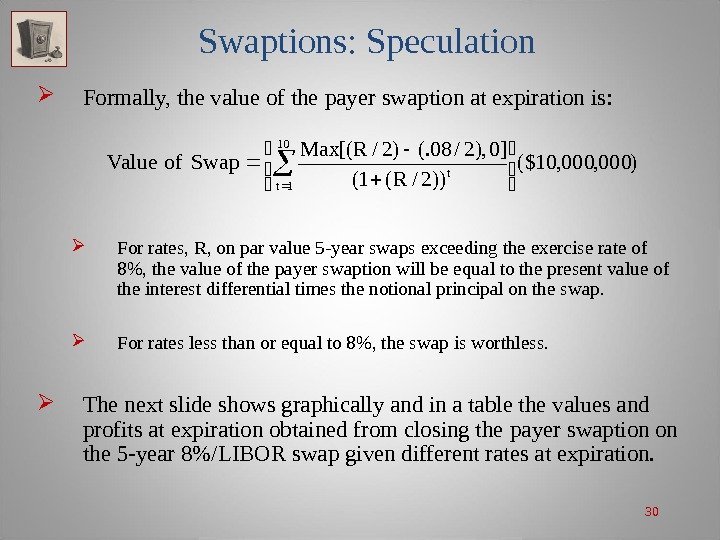

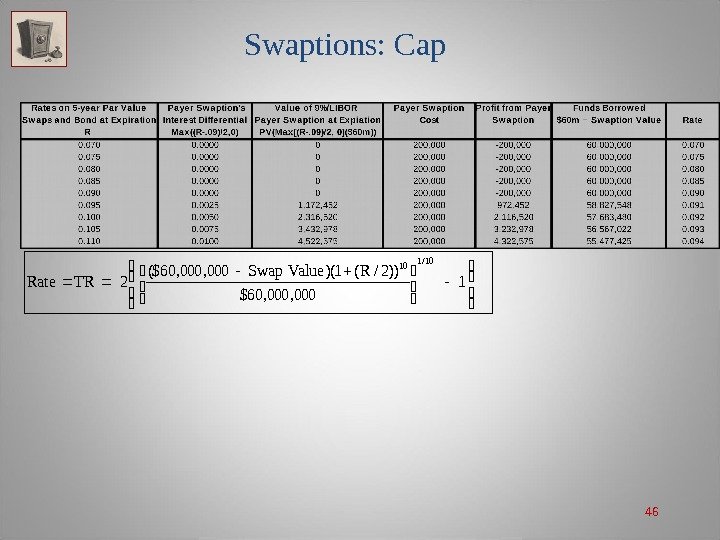

There are two types of swaption contracts analogous to put and call options.

Par yield curve swaption. A receiver swaption gives the owner of the swaption the right to enter into a swap in which they will receive the fixed leg and pay the floating leg. A payer swaption gives the owner of the swaption the right to enter into a swap where they pay the fixed leg and receive the floating leg. Thus on a given exercise date the schedule might specify that abc would need to pay 102 for the bond originally at par 100. On the par yield curve the coupon rate will equal the yield to maturity of the.

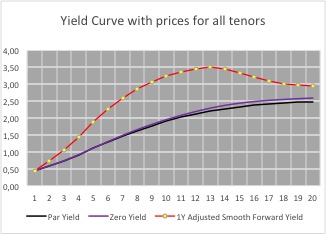

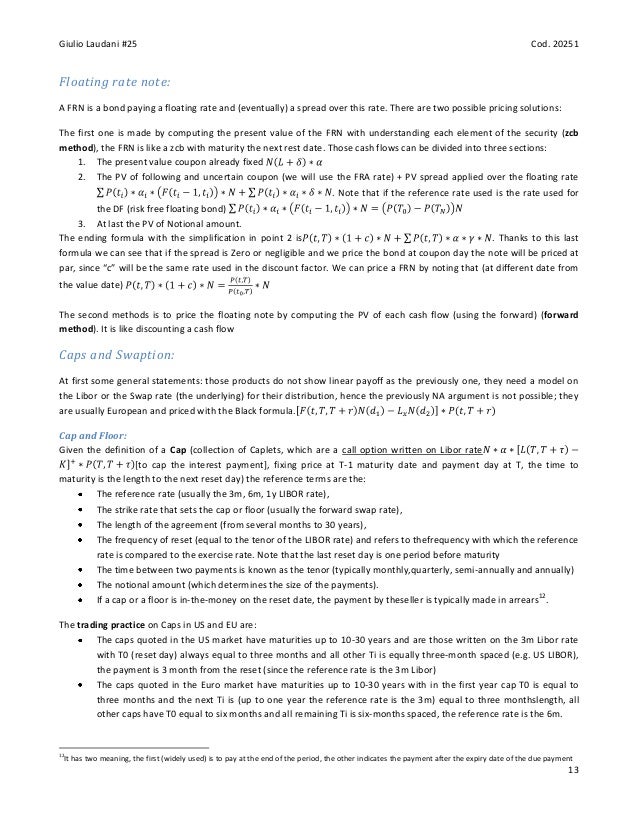

17 2 f and b the amount payable by the fixed rate payer under the relevant swap transaction. Hedging depends on the shape of the yield curve and the shape changes. Pricer for swaption with par yield curve method of cash settlement in a log normal or black model on the swap rate. The volatility parameters are not adjusted for the underlying swap convention.

A par yield curve is a graph of the yields on hypothetical treasury securities with prices at par. Par yield curve unadjusted. If the eur ice swap rate is not published on the relevant page the rate will be determined on the basis of the par swap rates quoted by. Following on from last year s isda survey on changing the market convention for the cash settlement of eur swaptions from par yield curve unadjusted to collateralized cash price isda has updated the 2006 isda definitions settlement matrix for early termination and swaptions the isda settlement matrix effective november 26 2018 to show collateralized cash price as the.

Thus the structure is long 8yr gamma short 7yr gamma on a par curve. Par yield curve adjusted the cash settlement amount is the present value of an annuity equal to the difference between a the amount payable by the fixed rate payer as if the fixed rate were the settlement rate c f. Using this method will show that when rates sell off by parallel 1bp the 7yr1yr payer swaption will get shorter the 7y1yr forward rate which will be shown as short 8yr long 7yr on a par curve. A wide variety of swaps are utilized in finance in order to hedge risks including interest rate swaps credit default swaps asset swaps and currency swaps an interest rate swap is a contractual.

A bermuda swaption has a discrete exercise schedule. The swap underlying the swaption must have a fixed leg on which the forward rate is computed.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)