Par Yield Curve Wiki

Converting from par rates to zero coupon rates.

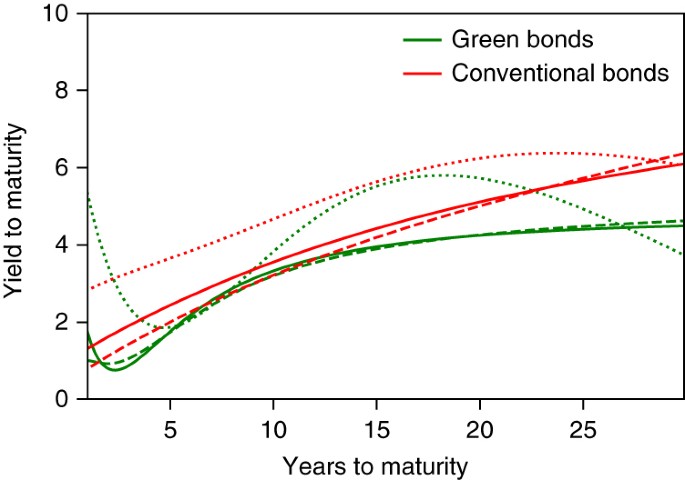

Par yield curve wiki. This is illustrated on the page converting from par rates. The par yield is known as the par rate swap rate or swap yield. The par yield curve plots yield to maturity against term to maturity for current bonds trading at par. A par yield curve is a graph of the yields on hypothetical treasury securities with prices at par.

The par yield c for a n year maturity fixed bond satisfies the following equation this can be more succinctly expressed with the. An application of par yields is the pricing of new coupon paying bonds. It is used in the design of fixed interest securities and in constructing interest rate swaps. If we know the par yield we can calculate both the zero coupon yield and the forward yield for the same maturities and risk class.

These rates are commonly referred to as constant maturity treasury rates or cmts. This curve which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded treasury securities in the over the counter market. The yield value strongly depends on the sample preparation and pretreatment of the sample before starting the measurement 8 9. On the run treasury yield curve.

Par yield or par rate denotes in finance the coupon rate for which the price of a bond is equal to its nominal value or par value. The maximum yield stress which can be detected during the measurement is the yield point value. To measure the yield point a constant low speed is preset on the rotational viscometer. The par rate is equal to the fixed coupon rate payable on a par bond.

If we know the par yield we can calculate both the zero coupon yield and the forward yield for the same maturities and risk class. Treasury yield curve derived using on the run treasuries. Since this yield curve represents bonds of identical credit risks basically risk free the zero coupon curve the discount curve the forward curve and the par yield curve are just different representations of the same thing and can be translated very easily from each other. On the par yield curve the coupon rate will equal the yield to maturity of the.

Yield curves are usually upward sloping asymptotically. The longer the maturity the higher the yield with diminishing marginal increases that is as one moves to the right the curve flattens out. Yields are interpolated by the treasury from the daily yield curve. The par yield is known as the par rate swap rate or swap yield.

The par yield curve the par yield curve is not usually encountered in secondary market trading however it is often constructed for use by corporate financiers and others in the new issues or primary market. The on the run treasury curve is the primary benchmark used in pricing fixed income securities.

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

:max_bytes(150000):strip_icc()/YieldCurve2-362f5c4053d34d7397fa925c602f1d15.png)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)