Par Yield Curve Zero Coupon

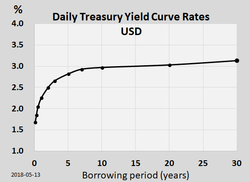

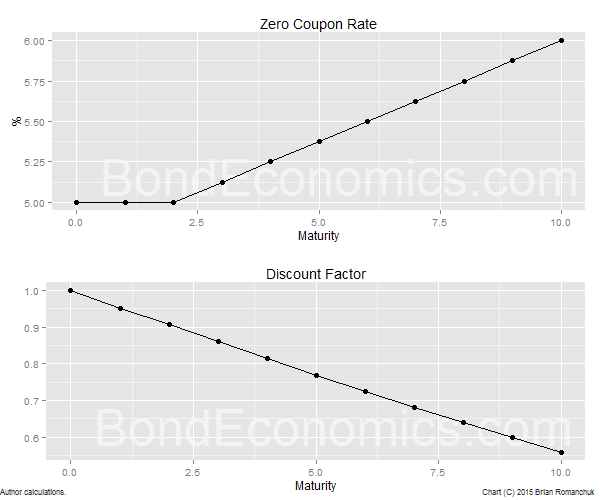

Zero coupon curves are a building block for interest rate pricers but they are less commonly encountered away from such uses.

Par yield curve zero coupon. As explained for example here a bond that has theoretical coupons equal to its yield is priced at par 100. Another approach is to derive a yield curve first. Par curve and all bonds on this curve are supposed to have the same annual yields. Now for a zero coupon with a maturity of 6 months it will receive a single coupon equivalent to the bond yield.

Flat curve and all bonds on this curve are supposed to have the same liquidity and similar tax status. That s why a yield curve constructed in this way is also called a coupon curve. Par and zero coupon curves are two common ways of specifying a yield curve. It is a construction of time to maturity at the x axis and yield to maturity on the y axis.

Hence the spot rate for the 6 month zero coupon bond will be 3. On the par yield curve the coupon rate will equal the yield to maturity of the. Par coupon yields are quite often encountered in economic analysis of bond yields such as the fed h 15 yield series. The yield curve derived from a sequence of yields to maturity on zero coupon bonds is called the.

For a 1 year bond there will be two cash flows at 6 months and at 1 year.

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)