Par Yield From Zero Rates

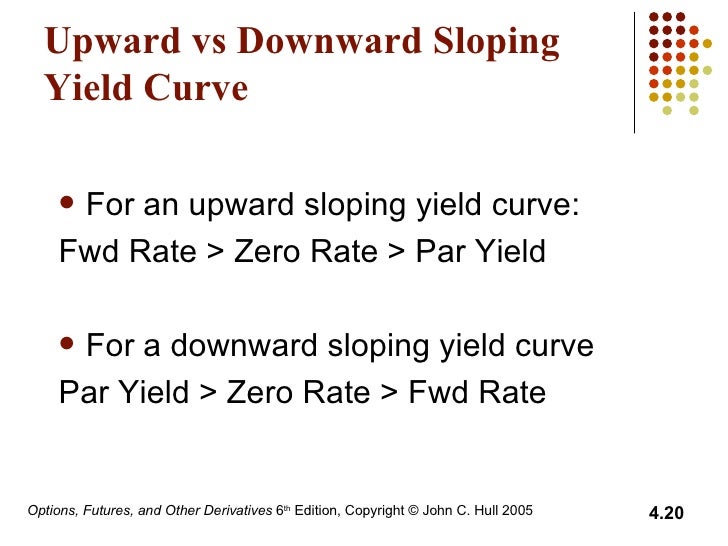

In this situation any three year nonzero coupon bond yields less than 3.

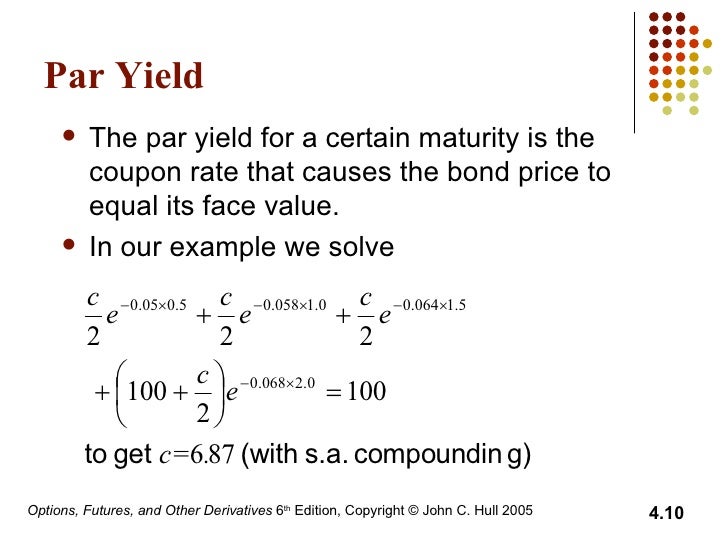

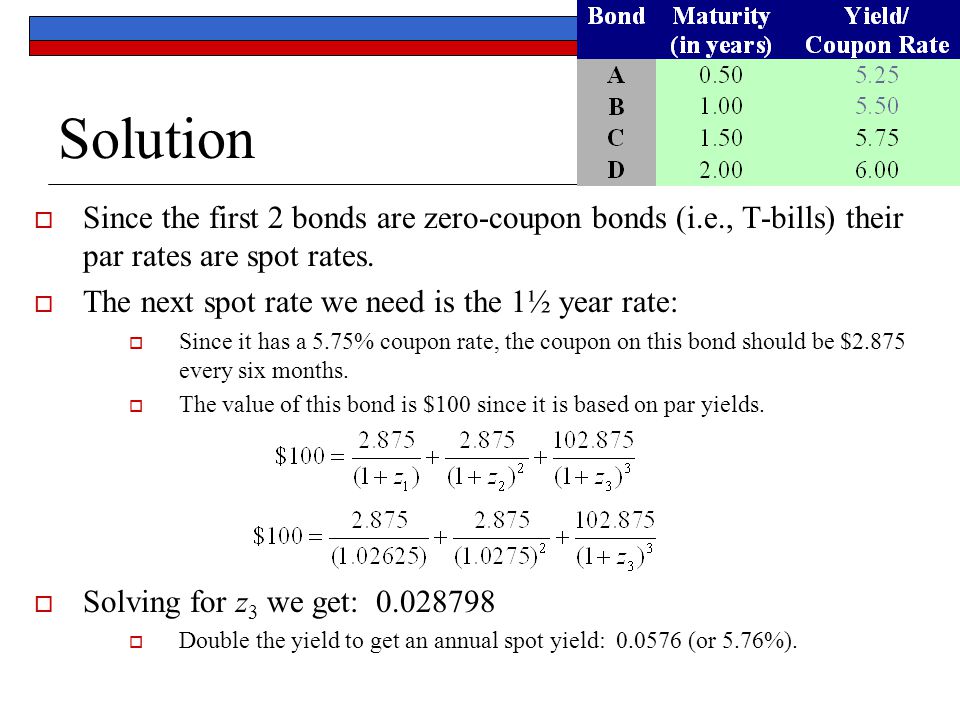

Par yield from zero rates. Begingroup we don t know the par yield all we know is the zcb rates say 1 2 3. In order to derive a zero rates curve from this you can apply a bootstrapping procedure. The par yield is known as the par rate swap rate or swap yield. The par yield c for a n year maturity fixed bond satisfies the following equation this can be more succinctly expressed with the.

It is used in the design of fixed interest securities and in constructing interest rate swaps. That s why a yield curve constructed in this way is also called a coupon curve. The spot rate is calculated by finding the discount rate that makes the present value pv of. This is the result of my choice of calculation conventions.

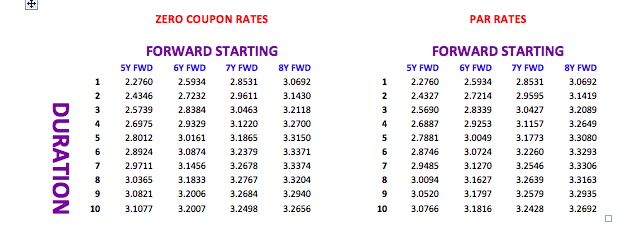

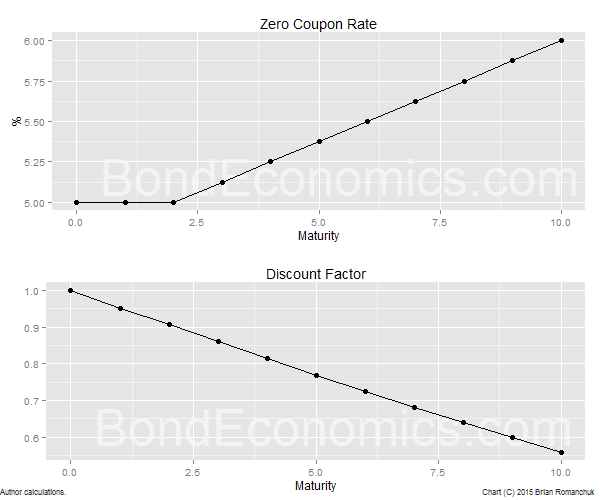

Converting from par rates to zero coupon rates. On the par yield curve the coupon rate will equal the yield to maturity of the. For the first 2 years the zero rate and the par coupon yield are the same as the curve was flat at 5. Par yield or par rate denotes in finance the coupon rate for which the price of a bond is equal to its nominal value or par value.

We then use these rates to calculate the 1 5 year spot rate. And the par rate on a 1 5 year semi annual coupon bond r3 4 5. We make 3 on the final cash flow but on the first and second coupon we make 1 and 2 respecitvely which drags down the return to less than 3. The chart above shows the par coupon yields as well as the zero rates for maturities from 0 to 10.

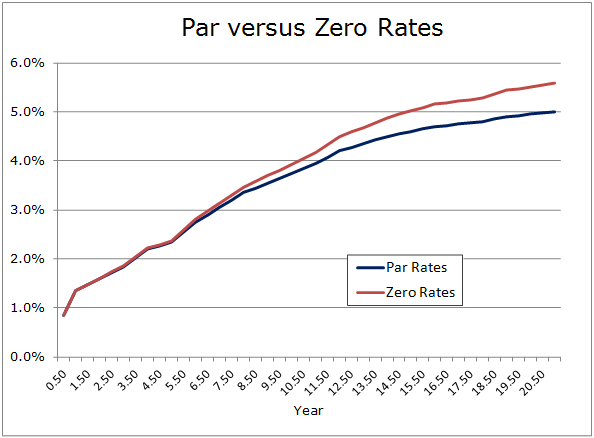

So all the coupon bonds and in particular the par coupon bond yield less than 3. In this video the spot rate curve is upward sloping such that the 4 year zero rate is 9 00 and the implied 4 year par yield is 8 57. This is an iterative process that allows us to derive a zero coupon yield curve from the rates prices of coupon bearing instruments. 0 5 year spot rate z1 4 and 1 year spot rate z2 4 3 we can get these rates from t bills which are zero coupon.

Bonds trading above par value or premium bonds have a yield to maturity lower than the coupon rate. Once all the par term structure rates have been derived we us the bootstrapping method for deriving the zero curve from the par term structure. A par yield curve is a graph of the yields on hypothetical treasury securities with prices at par. To me the hard part is the definition of par yield the par yield is the yield to maturity that prices a bond exactly at par so this is about the relationship between yield and the spot rate curve.

As explained for example here a bond that has theoretical coupons equal to its yield is priced at par 100.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)