The Par Value Of Preference Shares

If a business releases stock with a low par value of 5 00 per share and 1 000 shares are sold the associated book value of the business can then be listed as 5 000.

The par value of preference shares. The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value. The shares in a corporation may be issued partly paid which renders the owner of those shares liability to the corporation for any calls on those shares up to the par value of the shares. Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. Par value for stock.

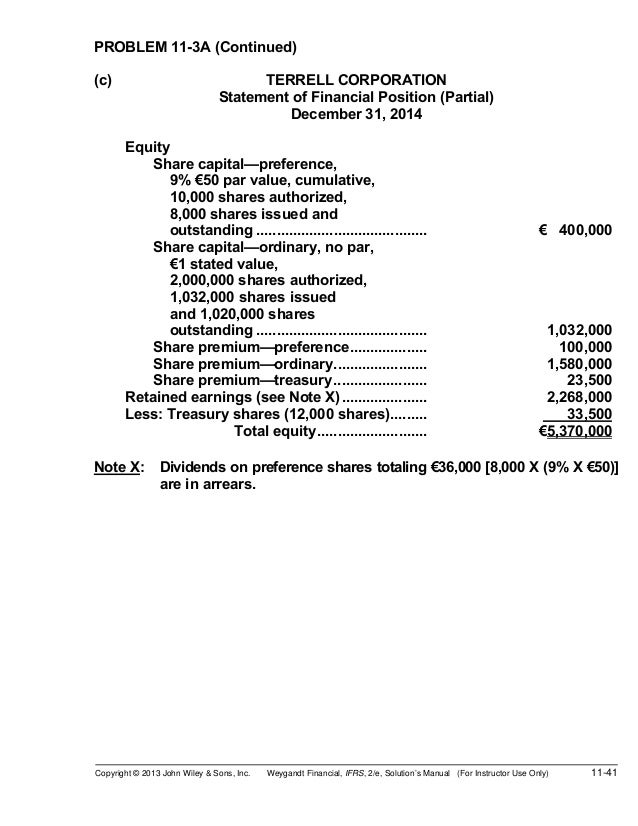

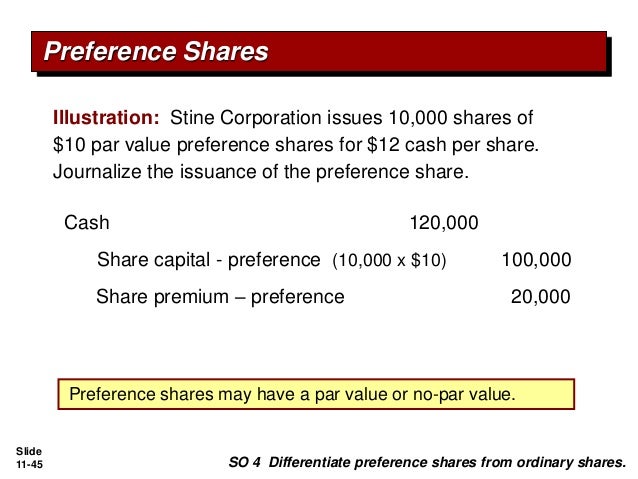

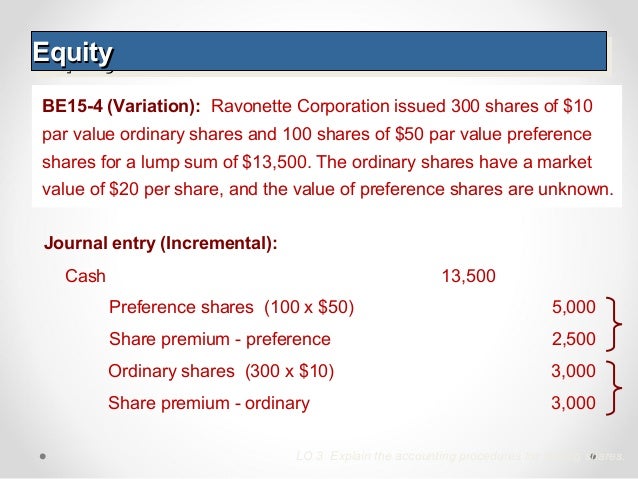

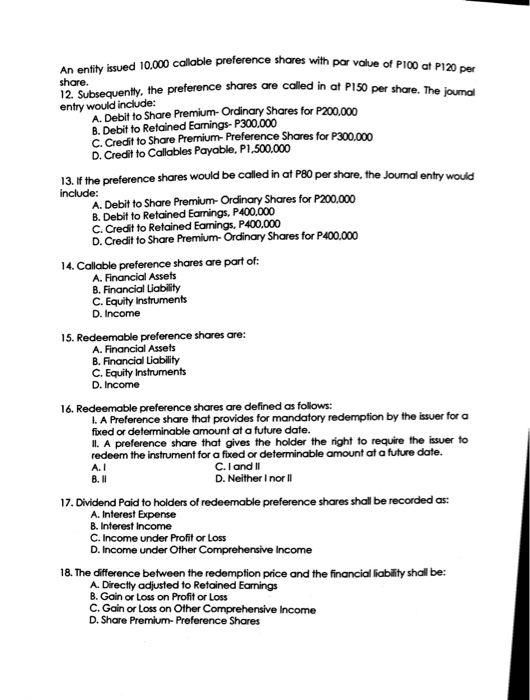

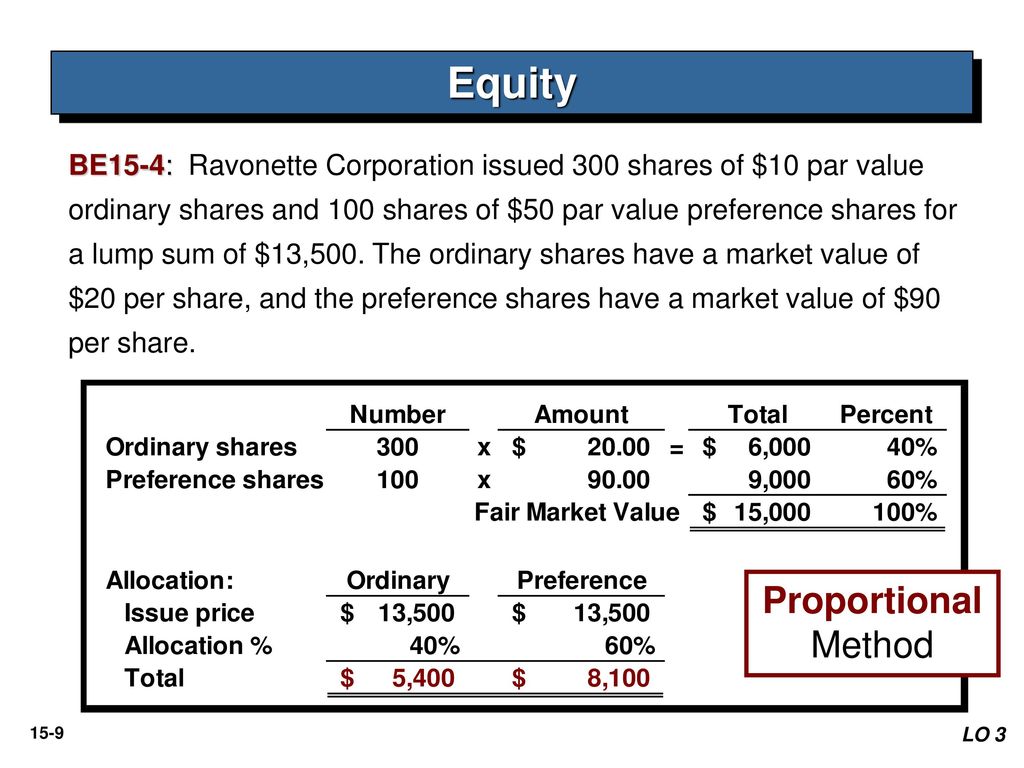

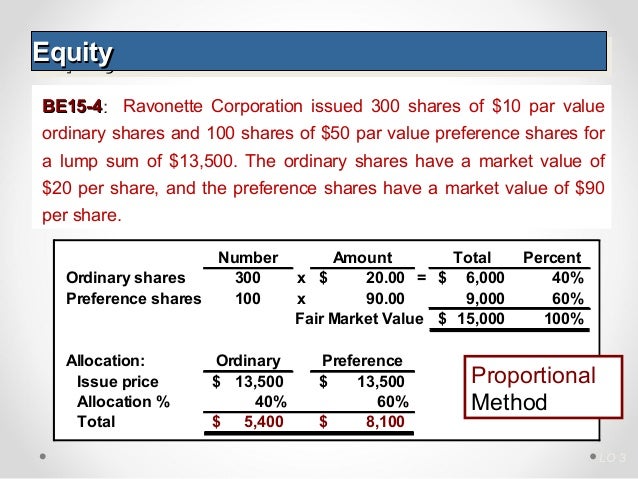

Preferred stocks are senior i e higher ranking to common stock but subordinate to bonds in terms of. What is par value of share. Preferred stock also called preferred shares preference shares or simply preferreds is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument and is generally considered a hybrid instrument. Par value of preferred stock number of issued shares x par value per share.

Preference dividend to be paid for the year 2015 1 500 000 3 000 000 10 5 100. So multiply the number of shares issued by the par value per share to calculate the par value of preferred stock. Par value is the stock price stated in a corporation s charter. Also companies are not required to have an authorized capital which is the maximum value of shares which a company may issue.

No par value stock is shares that have been issued without a par value listed on the face of the stock certificate historically par value used to be the price at which a company initially sold its shares. In this example multiply 1 000 by 1 to get 1 000 in par value of preferred stock. However par value is now usually set at a minimal amount such as 0 01 per share since some state laws still require that a company cannot. The call price is usually either par value or a small fixed percentage over par value.

All you have to do now is run a simple calculation. Bond par value. 2 3 shares issued by companies incorporated in singapore have no par value. Available cash balance 1 000 000.

In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. This means that the liabilities of the members are measured by the amount of consideration unpaid on the shares held by them. There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the. The par value of a fixed income security indicates the amount that the issuer will pay to the bondholder when the debt matures and must be paid back.

/stock_certificates-5bfc321a4cedfd0026c24c0c.jpg)