Yield Curve Par Curve

The par curve is a sequence of yields to maturity such that each bond is priced at par value.

Yield curve par curve. When a bond is priced at par the yield to maturity is equal to the coupon rate. That s why a yield curve constructed in this way is also called a coupon curve. When people quote the par curve. All bonds on the par curve are supposed to have the same credit risk periodicity currency liquidity tax status and annual yields.

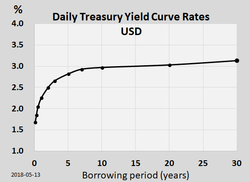

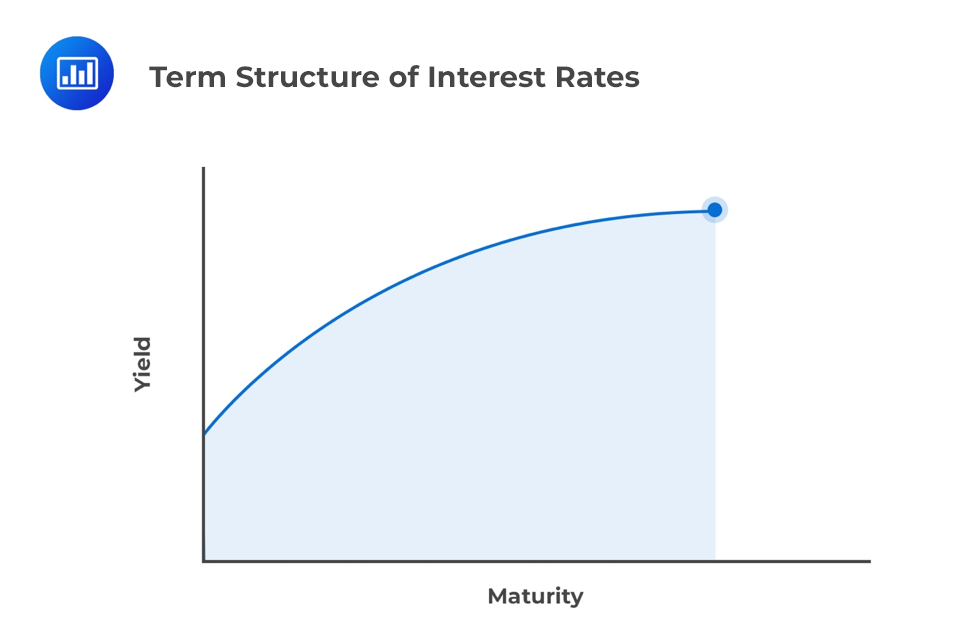

A par yield curve is a graph of the yields on hypothetical treasury securities with prices at par. It is a construction of time to maturity at the x axis and yield to maturity on the y axis. When the yield curve is upward sloping the yield on an n year coupon bearingbond is less than the yield on an n year zero coupon bond. The longer the maturity the higher the yield with diminishing marginal increases that is as one moves to the right the curve flattens out.

Par coupon yields are quite often encountered in economic analysis of bond yields such as the fed h 15 yield series. Par and zero coupon curves are two common ways of specifying a yield curve. On the par yield curve the coupon rate will equal the yield to maturity of the. Another approach is to derive a yield curve first.

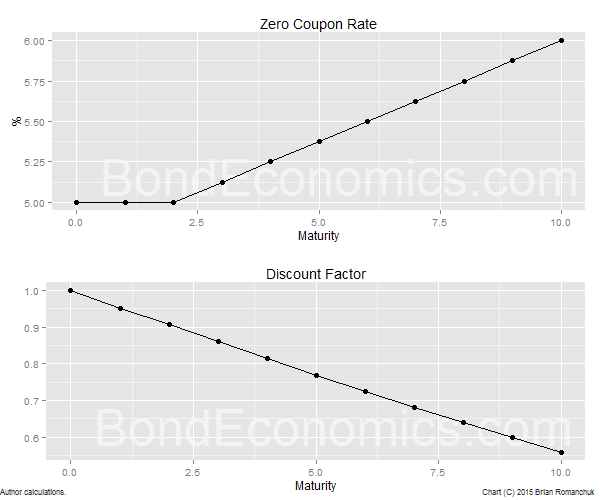

Whereas the par curve gives a yield that is used to discount multiple cash flows i e all of the cash flows coupons and principal for a coupon paying bond the spot curve gives a yield that is used to discount a single cash flow at a given maturity called a spot payment. Reading 44 los 44i. First it may be that the market is anticipating a rise in the risk free rate if investors hold off investing now they may. The zero rate is the yield on a zero coupon bond.

The spot curve is more often user to calculate the fair value of a particular bond. It gives the ytm for zero coupon as opposed to coupon paying bonds. Define and compare the spot curve yield curve on coupon bonds par curve and forward curve. Yield curves are usually upward sloping asymptotically.

Also called full coupon yield curve on the run treasury yield curve par yield curve par curve. Zero coupon curves are a building block for interest rate pricers but they are less commonly encountered away from such uses. There are two common explanations for upward sloping yield curves. A par yield curve is a graphical representation of the yields of hypothetical treasury securities with prices at par.

Trying to keep the math out of the answer a par curve is the most commonly referred to curve by media and market watchers.

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)